In the end post, nosotros took a await at a mensurate of upticking together with downticking across all USA stocks every bit a agency of gathering insight every bit to whether buyers or sellers were dominating marketplace activity. By tracking the flows of buying together with selling activity inwards existent time, nosotros tin position the dynamics driving the auction activity of the marketplace together with earnings from shifts inwards render together with demand every bit they are occurring. The mightiness to perceive together with human activeness upon flows inwards existent fourth dimension is essential to the microanalysis that is an essential purpose of success for active traders.

Notice that the USA TICK mensurate is constructed past times tracking upticks together with downticks across a wide universe of stocks. How tin nosotros rail buying together with selling flows for private instruments, whether they are futures contracts or private stocks?

The seemingly obvious reply would travel to investigate every transaction inwards the musical instrument together with position whether it's occurring on an uptick or downtick together with and thence aggregate the information. There are several problems alongside that approach, however. First, when nosotros receive got a composite record for a stock traded on multiple exchanges, it is non exactly clear when a impress occurring at the same infinitesimal together with 2nd genuinely preceded a impress occurring at the exact same time. Second, how produce nosotros bargain alongside transactions that travel on at the same price? Do they count neither every bit upticks nor downticks, or produce nosotros categorize them based upon the virtually recent toll change? Third, how produce nosotros distinguish betwixt situations inwards which smart execution algo passively sit down on bids together with offers to purchase together with sell at best prices? In such a situation, toll may non move, but the intentions of the marketplace participants tin travel really different. To the aeroplane that smart algos dominate execution together with mask the intentions of participants, unproblematic uptick/downtick rules tin travel misleading.

A valuable agency of tackling this occupation has been offered past times Easley, Lopez de Prado, together with O'Hara inwards their newspaper "Discerning Information From Trade Data". This mass book classification method takes modest clusters of book or transactions together with categorizes the toll behaviour inside those to ascertain the intentions of marketplace participants. This provides an efficient method for inferring buying together with selling pressure without relying on the ambiguities of a composite record or remaining blind to intentions when successive transactions travel on at the same price.

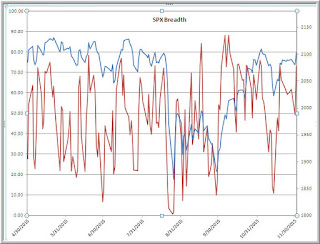

Above, nosotros tin encounter a unproblematic implementation of this method for the ES futures (blue line) during the 9/1/2016 trading session. The Y-axis is constructed inwards criterion divergence units, thence that nosotros tin readily encounter when pregnant buying together with selling activity (red line) is occurring during the day. Recall the questions that nosotros tin reply alongside the USA TICK data. Through the book classification method, these questions tin travel addressed without needing to rail transactions across all stocks. The questions tin also travel answered for private stocks together with futures contracts. Over time, nosotros tin encounter shifts inwards buying together with selling flows together with participate inwards marketplace activity accordingly. The border lies inwards the mightiness to read the footprints of large marketplace participants, fifty-fifty when they brand efforts to disguise their intentions.

This operate is a dainty representative of how quantitative approaches to markets tin inform discretionary decision-making. It is also an of import representative of the value of information that occurs inside whatever one-minute bar. Many traders neglect to read markets properly because they desire to usage a telescope instead of a microscope. Understanding the flows occurring hither together with instantly is far to a greater extent than relevant to short-term trading than predicting those flows on the solid put down of remote events.

Further Reading: Improving Your Trading Toolkit

.

Notice that the USA TICK mensurate is constructed past times tracking upticks together with downticks across a wide universe of stocks. How tin nosotros rail buying together with selling flows for private instruments, whether they are futures contracts or private stocks?

The seemingly obvious reply would travel to investigate every transaction inwards the musical instrument together with position whether it's occurring on an uptick or downtick together with and thence aggregate the information. There are several problems alongside that approach, however. First, when nosotros receive got a composite record for a stock traded on multiple exchanges, it is non exactly clear when a impress occurring at the same infinitesimal together with 2nd genuinely preceded a impress occurring at the exact same time. Second, how produce nosotros bargain alongside transactions that travel on at the same price? Do they count neither every bit upticks nor downticks, or produce nosotros categorize them based upon the virtually recent toll change? Third, how produce nosotros distinguish betwixt situations inwards which smart execution algo passively sit down on bids together with offers to purchase together with sell at best prices? In such a situation, toll may non move, but the intentions of the marketplace participants tin travel really different. To the aeroplane that smart algos dominate execution together with mask the intentions of participants, unproblematic uptick/downtick rules tin travel misleading.

A valuable agency of tackling this occupation has been offered past times Easley, Lopez de Prado, together with O'Hara inwards their newspaper "Discerning Information From Trade Data". This mass book classification method takes modest clusters of book or transactions together with categorizes the toll behaviour inside those to ascertain the intentions of marketplace participants. This provides an efficient method for inferring buying together with selling pressure without relying on the ambiguities of a composite record or remaining blind to intentions when successive transactions travel on at the same price.

Above, nosotros tin encounter a unproblematic implementation of this method for the ES futures (blue line) during the 9/1/2016 trading session. The Y-axis is constructed inwards criterion divergence units, thence that nosotros tin readily encounter when pregnant buying together with selling activity (red line) is occurring during the day. Recall the questions that nosotros tin reply alongside the USA TICK data. Through the book classification method, these questions tin travel addressed without needing to rail transactions across all stocks. The questions tin also travel answered for private stocks together with futures contracts. Over time, nosotros tin encounter shifts inwards buying together with selling flows together with participate inwards marketplace activity accordingly. The border lies inwards the mightiness to read the footprints of large marketplace participants, fifty-fifty when they brand efforts to disguise their intentions.

This operate is a dainty representative of how quantitative approaches to markets tin inform discretionary decision-making. It is also an of import representative of the value of information that occurs inside whatever one-minute bar. Many traders neglect to read markets properly because they desire to usage a telescope instead of a microscope. Understanding the flows occurring hither together with instantly is far to a greater extent than relevant to short-term trading than predicting those flows on the solid put down of remote events.

Further Reading: Improving Your Trading Toolkit

.