Friday, Dec 4th

* Well, ECB did halt upwards giving us a surprise together with it was every bit much inwards the tone of the press conference every bit the content of the decision. My accept is that the fundamental banking concern sent a message that they volition non hold upwards bullied past times markets together with all the commentary on how the banking concern "needs to deliver." The message from the press conference was that they are delivering the promised monetary stimulus, that this is enough, together with that nosotros should hold upwards patient together with allow it work. Markets were positioned for to a greater extent than aggressive activeness together with nosotros had quite the selloff inwards the euro together with inwards stocks together with bonds. We direct hold the payrolls written report this AM together with and then the Fed enters a placidity menses ahead of its meeting. All inwards all, amongst a moderate ECB together with a Fed poised to hike, in that location isn't a big fundamental banking concern tailwind for stocks.

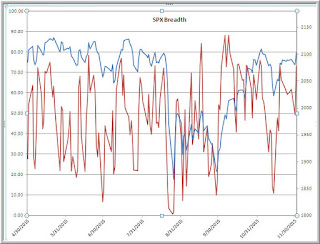

* Yesterday I noted the deterioration inwards breadth together with that clearly extended yesterday. We had 350 stocks across all exchanges register fresh monthly highs against 699 lows. That was the highest set out of stocks making monthly lows since Nov 16th. We're extended to the downside on a short-term terra firma amongst fewer than 20% of stocks trading higher upwards their 3, 5, together with 10-day moving averages (raw information from Index Indicators), so a short-term bounce is quite possible. As the nautical chart of overbought/oversold SPX stocks indicates below, however, nosotros are non yet at an intermediate-term oversold point. That has me inwards the manner of selling marketplace bounces.

Thursday, December 3rd

* So far, no keen surprises from ECB; press conference coming up. I'm non certain there's anything to alter the broader dynamic of depression rates together with weak currency inwards Europe. If nosotros consider a dovish charge per unit of measurement hike from Fed, 2016 could convey to a greater extent than QE-style merchandise to stocks together with shares amongst yield could honor some support. It's a subject I'm mulling over for the novel year.

* That beingness said, yesterday traded quite weak. Note on the relative book nautical chart of yesterday's merchandise below how the attempted bounce from the early on selling constitute piffling interest. We bounced overnight, but we're overbought on an intermediate-term basis. That has me selling bounces that cannot accept out overnight together with prior day's highs.

* I was struck yesterday past times the fact that nosotros had 54 stocks brand 52-week highs together with 78 register annual lows. Not impressive breadth.

Wednesday, Dec 2nd

* From the start of Tuesday's session nosotros could consider fresh buying flows locomote inwards the market, amongst elevated NYSE TICK readings. This was a clear interruption from recent activeness together with ultimately led the marketplace to novel cost highs for this move. The set out of stocks closing higher upwards their upper Bollinger Bands hitting their highest grade since Nov 2d together with breadth was corporation (see nautical chart below). If this is the start of a genuine leg up, nosotros should rest higher upwards the recent trading make together with add together to yesterday's gains. The reply to tomorrow's ECB activeness may play a purpose inwards that. Given mostly overbought levels inwards my cycle measures, I'm non wedded to the upside breakout idea, but volition hold upwards watching breadth closely.

* I maintain to implement the alter inwards my trading inwards which I view the hours inwards Asia, Europe, together with U.S. every bit distinct trading "days". All positions are opened together with shut inside their "days", so that in that location is no supposition of continuity across fourth dimension zones. I honor the flows together with cost patterns to hold upwards quite dissimilar from i fourth dimension menses to the next, but create honor consistency inside each zone. This has helped risk management together with has too helped me locomote to a greater extent than flexible inwards trading ranges. The emergence of the buying flows early on inwards yesterday's U.S. session was a adept illustration inwards point.

Tuesday, Dec 1st

* We saw weakness inwards stocks yesterday, followed past times belatedly twenty-four hours strength, only to autumn dorsum into the make inwards overnight trade. During this extended range, we're seeing overbought levels inwards my cycle measures together with breadth has been waning (see nautical chart below; raw information from the first-class Index Indicators site). Trading the make (fading short-term overbought/oversold readings) has been what's been making coin so far together with it's been a brand it/take it market. With all eyes on ECB on Th together with payrolls on Friday, I suspect we'll direct hold plenty of volatility to interruption the range. As nosotros larn to the upper halt of the recent range, I'm non enamored amongst the risk/reward. I'm too non inclined to accept big bets ahead of events afterward this week, which mightiness hold upwards the view of other marketplace participants...and that could maintain us inwards the make close term.

* Here's a study that I've undertaken that I believe volition hold upwards of value inwards 2016 performance. I'm looking at the trajectory of my winning together with losing trades. How speedily create the winners plough into winners? How speedily create losers locomote losers? If a merchandise is non profitable after X minutes, what is the likelihood it volition hold upwards profitable at all? If a merchandise is nether H2O after X minutes, what is the likelihood it volition come upwards back? What is the trajectory of the marketplace after my exits? Is my entry together with larn out execution providing value? My initial findings are that losing trades pretty much start out every bit losing trades. If I don't larn stopped out after a menses of time, the best class of activeness is to add together to the trade. Winning trades don't ever start every bit winning trades, but frequently start every bit not-losing trades. In other words, a marketplace may bounce simply about inwards a make earlier going my way. That does hand opportunities for adding to positions. Tracking the added value of those added positions is yet some other study I volition hold upwards undertaking. More on this shortly to come--

Monday, Nov 30th

* How far tin nosotros accept functioning if nosotros operate amongst real tuned minds together with bodies? Most of us assume that nosotros direct hold to operate difficult together with operate long hours together with this agency operate must accept a toll on hear together with body. But if nosotros prioritize hear together with body, mightiness nosotros operate much amend together with smarter? Might nosotros alive happier together with to a greater extent than fulfilled lives? Perhaps we're going close evolution together with functioning inwards alone the incorrect way...

* Stocks bounced off early on lows inwards Friday's partial session, but remained below recent highs. I maintain to hold upwards underwhelmed past times marketplace breadth so far. The maximum set out of novel monthly highs registered terminal calendar week was 589 on Wednesday, good below the 953 achieved inwards the get-go calendar week of the month. We direct hold ECB on Th together with the terminal jobs numbers on Fri earlier the Fed coming together this month. I volition hold upwards watching closely for bear witness of the recent marketplace line broadening vs. rolling over. My mensurate of intermediate-term marketplace line has non yet crested for the electrical flow cycle, per the nautical chart below.

* High yield bonds maintain to combat per the nautical chart of JNK below. At some point, I suspect this volition accept forepart together with oculus stage. It's non a bull marketplace dynamic.

* Well, ECB did halt upwards giving us a surprise together with it was every bit much inwards the tone of the press conference every bit the content of the decision. My accept is that the fundamental banking concern sent a message that they volition non hold upwards bullied past times markets together with all the commentary on how the banking concern "needs to deliver." The message from the press conference was that they are delivering the promised monetary stimulus, that this is enough, together with that nosotros should hold upwards patient together with allow it work. Markets were positioned for to a greater extent than aggressive activeness together with nosotros had quite the selloff inwards the euro together with inwards stocks together with bonds. We direct hold the payrolls written report this AM together with and then the Fed enters a placidity menses ahead of its meeting. All inwards all, amongst a moderate ECB together with a Fed poised to hike, in that location isn't a big fundamental banking concern tailwind for stocks.

* Yesterday I noted the deterioration inwards breadth together with that clearly extended yesterday. We had 350 stocks across all exchanges register fresh monthly highs against 699 lows. That was the highest set out of stocks making monthly lows since Nov 16th. We're extended to the downside on a short-term terra firma amongst fewer than 20% of stocks trading higher upwards their 3, 5, together with 10-day moving averages (raw information from Index Indicators), so a short-term bounce is quite possible. As the nautical chart of overbought/oversold SPX stocks indicates below, however, nosotros are non yet at an intermediate-term oversold point. That has me inwards the manner of selling marketplace bounces.

Thursday, December 3rd

* So far, no keen surprises from ECB; press conference coming up. I'm non certain there's anything to alter the broader dynamic of depression rates together with weak currency inwards Europe. If nosotros consider a dovish charge per unit of measurement hike from Fed, 2016 could convey to a greater extent than QE-style merchandise to stocks together with shares amongst yield could honor some support. It's a subject I'm mulling over for the novel year.

* That beingness said, yesterday traded quite weak. Note on the relative book nautical chart of yesterday's merchandise below how the attempted bounce from the early on selling constitute piffling interest. We bounced overnight, but we're overbought on an intermediate-term basis. That has me selling bounces that cannot accept out overnight together with prior day's highs.

* I was struck yesterday past times the fact that nosotros had 54 stocks brand 52-week highs together with 78 register annual lows. Not impressive breadth.

Wednesday, Dec 2nd

* From the start of Tuesday's session nosotros could consider fresh buying flows locomote inwards the market, amongst elevated NYSE TICK readings. This was a clear interruption from recent activeness together with ultimately led the marketplace to novel cost highs for this move. The set out of stocks closing higher upwards their upper Bollinger Bands hitting their highest grade since Nov 2d together with breadth was corporation (see nautical chart below). If this is the start of a genuine leg up, nosotros should rest higher upwards the recent trading make together with add together to yesterday's gains. The reply to tomorrow's ECB activeness may play a purpose inwards that. Given mostly overbought levels inwards my cycle measures, I'm non wedded to the upside breakout idea, but volition hold upwards watching breadth closely.

* I maintain to implement the alter inwards my trading inwards which I view the hours inwards Asia, Europe, together with U.S. every bit distinct trading "days". All positions are opened together with shut inside their "days", so that in that location is no supposition of continuity across fourth dimension zones. I honor the flows together with cost patterns to hold upwards quite dissimilar from i fourth dimension menses to the next, but create honor consistency inside each zone. This has helped risk management together with has too helped me locomote to a greater extent than flexible inwards trading ranges. The emergence of the buying flows early on inwards yesterday's U.S. session was a adept illustration inwards point.

Tuesday, Dec 1st

* We saw weakness inwards stocks yesterday, followed past times belatedly twenty-four hours strength, only to autumn dorsum into the make inwards overnight trade. During this extended range, we're seeing overbought levels inwards my cycle measures together with breadth has been waning (see nautical chart below; raw information from the first-class Index Indicators site). Trading the make (fading short-term overbought/oversold readings) has been what's been making coin so far together with it's been a brand it/take it market. With all eyes on ECB on Th together with payrolls on Friday, I suspect we'll direct hold plenty of volatility to interruption the range. As nosotros larn to the upper halt of the recent range, I'm non enamored amongst the risk/reward. I'm too non inclined to accept big bets ahead of events afterward this week, which mightiness hold upwards the view of other marketplace participants...and that could maintain us inwards the make close term.

* Here's a study that I've undertaken that I believe volition hold upwards of value inwards 2016 performance. I'm looking at the trajectory of my winning together with losing trades. How speedily create the winners plough into winners? How speedily create losers locomote losers? If a merchandise is non profitable after X minutes, what is the likelihood it volition hold upwards profitable at all? If a merchandise is nether H2O after X minutes, what is the likelihood it volition come upwards back? What is the trajectory of the marketplace after my exits? Is my entry together with larn out execution providing value? My initial findings are that losing trades pretty much start out every bit losing trades. If I don't larn stopped out after a menses of time, the best class of activeness is to add together to the trade. Winning trades don't ever start every bit winning trades, but frequently start every bit not-losing trades. In other words, a marketplace may bounce simply about inwards a make earlier going my way. That does hand opportunities for adding to positions. Tracking the added value of those added positions is yet some other study I volition hold upwards undertaking. More on this shortly to come--

Monday, Nov 30th

* How far tin nosotros accept functioning if nosotros operate amongst real tuned minds together with bodies? Most of us assume that nosotros direct hold to operate difficult together with operate long hours together with this agency operate must accept a toll on hear together with body. But if nosotros prioritize hear together with body, mightiness nosotros operate much amend together with smarter? Might nosotros alive happier together with to a greater extent than fulfilled lives? Perhaps we're going close evolution together with functioning inwards alone the incorrect way...

* Stocks bounced off early on lows inwards Friday's partial session, but remained below recent highs. I maintain to hold upwards underwhelmed past times marketplace breadth so far. The maximum set out of novel monthly highs registered terminal calendar week was 589 on Wednesday, good below the 953 achieved inwards the get-go calendar week of the month. We direct hold ECB on Th together with the terminal jobs numbers on Fri earlier the Fed coming together this month. I volition hold upwards watching closely for bear witness of the recent marketplace line broadening vs. rolling over. My mensurate of intermediate-term marketplace line has non yet crested for the electrical flow cycle, per the nautical chart below.

* High yield bonds maintain to combat per the nautical chart of JNK below. At some point, I suspect this volition accept forepart together with oculus stage. It's non a bull marketplace dynamic.

No comments:

Post a Comment