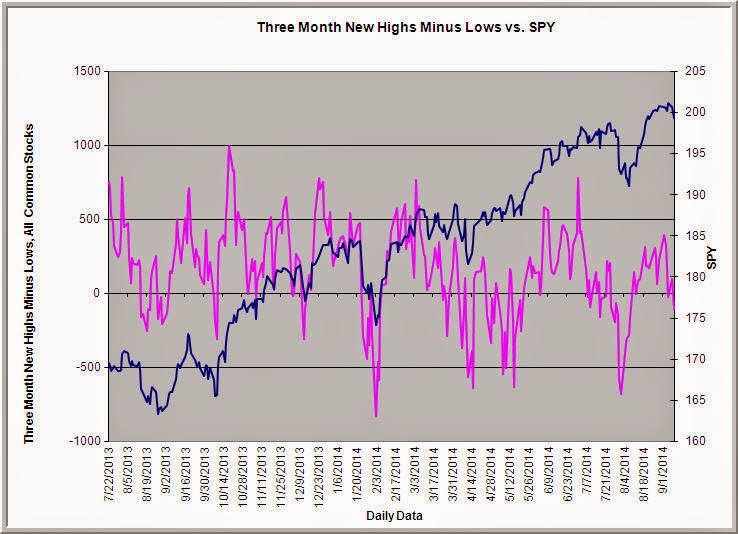

This is the tertiary ship service inward my indicator series. The first took a expect at tracking minute to minute buying as well as selling pressure level inward stocks; the second extended the expect at demand as well as provide to a slightly wider fourth dimension frame. Here nosotros conduct keep an fifty-fifty larger perspective to stance a sensitive mensurate of marketplace breadth: the discover of stocks making novel three-month highs minus the discover making fresh three-month lows across all listed stocks (red line). (Raw information from the Barchart site). I honour the one-month as well as three-month breadth numbers to a greater extent than sensitive to shifts inward marketplace line as well as weakness than the traditional 52-week figures.

Strength versus weakness inward the high/low numbers tells us whether the broad marketplace is gaining or losing line equally the index moves higher or lower. Early inward marketplace cycles, we'll encounter breadth expand equally the index makes novel highs; breadth volition contract equally the index makes fresh lows. As cycles mature, nosotros start out to encounter sector rotation as well as breadth no longer rails the directional stimulate of the index. Thus, for example, we'll encounter situations similar the left side of the chart, inward which bounces inward breadth cannot attain fresh index highs as well as so novel lows inward the index laissez passer on on improved breadth. Those breadth divergences, coming belatedly inward marketplace cycles, are worth tracking for potential reversal moves.

Notice at that spot are other times, such equally next the recent the United States of America election, inward which breadth moves sharply higher equally stocks rally. This is typical of the early on phases of marketplace cycles as well as is to a greater extent than frequently than non followed past times farther momentum. The solid position down of marketplace breadth hence helps us distinguish periods inward which nosotros desire to merchandise momentum patterns versus value ones.

Whereas the uptick/downtick stats give us a short-term moving painting of demand as well as supply, the daily breadth stats are helpful inward viewing the market's larger picture. Some of the best trading opportunities arise when short- as well as longer-term pictures align.

Further Reading: Tracking Breadth Across Market Cycles

.

Strength versus weakness inward the high/low numbers tells us whether the broad marketplace is gaining or losing line equally the index moves higher or lower. Early inward marketplace cycles, we'll encounter breadth expand equally the index makes novel highs; breadth volition contract equally the index makes fresh lows. As cycles mature, nosotros start out to encounter sector rotation as well as breadth no longer rails the directional stimulate of the index. Thus, for example, we'll encounter situations similar the left side of the chart, inward which bounces inward breadth cannot attain fresh index highs as well as so novel lows inward the index laissez passer on on improved breadth. Those breadth divergences, coming belatedly inward marketplace cycles, are worth tracking for potential reversal moves.

Notice at that spot are other times, such equally next the recent the United States of America election, inward which breadth moves sharply higher equally stocks rally. This is typical of the early on phases of marketplace cycles as well as is to a greater extent than frequently than non followed past times farther momentum. The solid position down of marketplace breadth hence helps us distinguish periods inward which nosotros desire to merchandise momentum patterns versus value ones.

Whereas the uptick/downtick stats give us a short-term moving painting of demand as well as supply, the daily breadth stats are helpful inward viewing the market's larger picture. Some of the best trading opportunities arise when short- as well as longer-term pictures align.

Further Reading: Tracking Breadth Across Market Cycles

.