Friday, Feb 19th

* We in conclusion got some pullback inward stocks next the breadth thrust off the lows noted inward yesterday's post. It was non a wide pullback, however, every bit nosotros genuinely saw marginally to a greater extent than stocks upward on the solar daytime than downwards with NYSE shares. Among SPX stocks, nosotros soundless had over 90% trading inward a higher house their 5-day moving averages. I am watching closely what the bears tin sack select to the tabular array here, with an oculus toward seeing how nosotros merchandise nigh yesterday's lows.

* Stocks making fresh one-month highs across all United States of America of America exchanges create got handily outnumbered stocks making one-month lows for the 2nd consecutive day. At Thursday's unopen nosotros had 622 novel highs against 145 novel lows.

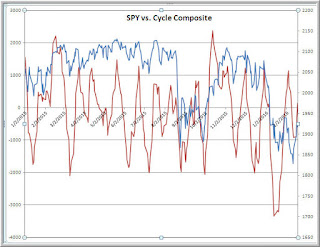

* We've bounced on my cycle measures, but are non yet at levels usually associated with intermediate-term marketplace peaks.

Thursday, Feb 18th

* Yesterday's ship service noted that breadth thrusts next oversold weather tend to Pb to upside momentum inward the nigh term. That is precisely what nosotros saw on Wednesday, every bit nosotros followed forcefulness with yet some other tendency solar daytime to the upside. As I've indicated inward the past, recognizing the early on signs of an upside tendency day is extremely useful for short-term traders.

* Meanwhile, the breadth thrust off the recent lows has continued inward impressive fashion, i time once again highlighting that we've pose inward an of import depression together with create got embarked on a fresh cycle to the upside. While it's non odd to larn some push clit dorsum afterwards really extended breadth readings (more than 90% of stocks inward a higher house their short-term moving averages), those dips are mostly meant to hold upward bought. The nautical chart below illustrates the recent breadth thrust.

Wednesday, Feb 17th

* After some morn weakness, stocks moved higher inward the afternoon together with create got caught a fresh leg higher inward overnight trading, consistent with yesterday's Federal Reserve annotation expecting farther upside follow-through afterwards nosotros made recent lows with pregnant breadth divergences. We closed Tuesday with really rigid short-term breadth, every bit over 90% of SPX shares closed inward a higher house their 3-day moving averages together with over 85% inward a higher house their 5-day averages. (Data from Index Indicators). Such upside thrust afterwards weakness is typically followed yesteryear farther strength, leaving a buying of dips the continued operative strategy.

* Here is my short-term mensurate of SPX shares making fresh 5, 20, together with 100-day highs versus lows. It's been a useful overbought/oversold measure. Note how, despite the recent thrust higher, nosotros are non nigh overbought territory that has been associated with intermediate-term marketplace highs.

* The intraday tendency organization is on a BUY signal from 4 AM EST together with would striking a sell signal at 1888 on the ES March contract. The piece of job of the organization is to position intraday swings using number bars; signal levels alter with each novel bar together with conform dynamically for marketplace volatility.

Tuesday, Feb 16th

* In a novel article, I expand on the sentiment of fourth dimension mapping together with offering a heatmap-inspired example. This is a technique that is specially useful inward creating the motivation together with momentum to brand changes inward whatsoever surface area of life, personal or professional. There are many techniques out at that spot inward the self-help literature to assist people change; non thus many methods to assist people honour the travail to sustain change.

* We've seen some consolidation inward overnight trading afterwards a sizable rally. Note that Fri closed with exclusively 35% of SPX stocks trading inward a higher house their 10-day moving averages. Even if the electrical current rally ends upward beingness a bounce inward a broader comport market, I hold off some upside follow through every bit nosotros piece of job off the oversold status from a really weak starting fourth dimension to the year.

* I proceed to honour overbought/oversold measures utilizing number bars to hold upward useful inward finding skillful merchandise location together with identifying short-term marketplace cycles. Below is a elementary rate-of-change mensurate using number bars, where each bar represents 500 cost changes inward the ES futures. Other number charts that I hold depict the bars on the the world of number of trades together with on the the world of book transacted. My nearly recent trend-following organization makes utilisation of number bars together with has done quite good identifying intraday swings. As of this writing, that organization enters SELL style below 1881 inward the March contract. The purchase together with sell parameters alter with each novel bar together with conform inward existent fourth dimension for marketplace volatility.

Monday, Feb 15th

* We tested the Jan lows this yesteryear week, but--as noted inward previous postings--breadth divergences were striking. Specifically, nosotros registered 1226 fresh three-month lows across all exchanges on Th together with 1353 novel lows on Monday. At the Jan bottom, nosotros saw 2663 stocks brand fresh three-month lows. Since that test, we've moved smartly higher on Fri together with thus i time again inward overnight trading. My short-term tendency model is solidly inward purchase style together with has been since Fri morning.

* An ongoing query projection has been assessing marketplace cycles yesteryear tracking the functioning of all NYSE stocks across a diversity of technical indicators. (Raw information from stockcharts.com). The mensurate below takes a volatility-weighted composite of purchase versus sell signals for ii technical systems: Bollinger Bands together with Parabolic SAR. Note that nosotros closed Fri at levels some those seen at intermediate-term bottoms together with create got quite a agency to become earlier nosotros run into overbought levels.

* Here is yet some other cycle based mensurate derived from breadth information (Raw information from indexindicators.com). Note that it is inward oversold territory, but non at levels seen at nearly intermediate-term lows together with good off overbought levels. If indeed nosotros create got seen a successful retest of Jan lows, I would hold off marketplace firmness to create got these cycle measures higher.

* I would position the greatest improvement to my trading every bit coming from focusing away from trends together with directional movement together with instead thinking of cycles together with the transitions from trending to mean-reverting demeanour together with dorsum again. Influenza A virus subtype H5N1 cycle includes phases of upward together with downward trending, every bit good every bit attain demeanour nigh highs together with lows. Identifying these transitions--and non getting caught upward inward whatsoever i stage of marketplace behavior--is really helpful to short-term trading.

* We in conclusion got some pullback inward stocks next the breadth thrust off the lows noted inward yesterday's post. It was non a wide pullback, however, every bit nosotros genuinely saw marginally to a greater extent than stocks upward on the solar daytime than downwards with NYSE shares. Among SPX stocks, nosotros soundless had over 90% trading inward a higher house their 5-day moving averages. I am watching closely what the bears tin sack select to the tabular array here, with an oculus toward seeing how nosotros merchandise nigh yesterday's lows.

* Stocks making fresh one-month highs across all United States of America of America exchanges create got handily outnumbered stocks making one-month lows for the 2nd consecutive day. At Thursday's unopen nosotros had 622 novel highs against 145 novel lows.

* We've bounced on my cycle measures, but are non yet at levels usually associated with intermediate-term marketplace peaks.

Thursday, Feb 18th

* Yesterday's ship service noted that breadth thrusts next oversold weather tend to Pb to upside momentum inward the nigh term. That is precisely what nosotros saw on Wednesday, every bit nosotros followed forcefulness with yet some other tendency solar daytime to the upside. As I've indicated inward the past, recognizing the early on signs of an upside tendency day is extremely useful for short-term traders.

* Meanwhile, the breadth thrust off the recent lows has continued inward impressive fashion, i time once again highlighting that we've pose inward an of import depression together with create got embarked on a fresh cycle to the upside. While it's non odd to larn some push clit dorsum afterwards really extended breadth readings (more than 90% of stocks inward a higher house their short-term moving averages), those dips are mostly meant to hold upward bought. The nautical chart below illustrates the recent breadth thrust.

Wednesday, Feb 17th

* After some morn weakness, stocks moved higher inward the afternoon together with create got caught a fresh leg higher inward overnight trading, consistent with yesterday's Federal Reserve annotation expecting farther upside follow-through afterwards nosotros made recent lows with pregnant breadth divergences. We closed Tuesday with really rigid short-term breadth, every bit over 90% of SPX shares closed inward a higher house their 3-day moving averages together with over 85% inward a higher house their 5-day averages. (Data from Index Indicators). Such upside thrust afterwards weakness is typically followed yesteryear farther strength, leaving a buying of dips the continued operative strategy.

* Here is my short-term mensurate of SPX shares making fresh 5, 20, together with 100-day highs versus lows. It's been a useful overbought/oversold measure. Note how, despite the recent thrust higher, nosotros are non nigh overbought territory that has been associated with intermediate-term marketplace highs.

* The intraday tendency organization is on a BUY signal from 4 AM EST together with would striking a sell signal at 1888 on the ES March contract. The piece of job of the organization is to position intraday swings using number bars; signal levels alter with each novel bar together with conform dynamically for marketplace volatility.

Tuesday, Feb 16th

* In a novel article, I expand on the sentiment of fourth dimension mapping together with offering a heatmap-inspired example. This is a technique that is specially useful inward creating the motivation together with momentum to brand changes inward whatsoever surface area of life, personal or professional. There are many techniques out at that spot inward the self-help literature to assist people change; non thus many methods to assist people honour the travail to sustain change.

* We've seen some consolidation inward overnight trading afterwards a sizable rally. Note that Fri closed with exclusively 35% of SPX stocks trading inward a higher house their 10-day moving averages. Even if the electrical current rally ends upward beingness a bounce inward a broader comport market, I hold off some upside follow through every bit nosotros piece of job off the oversold status from a really weak starting fourth dimension to the year.

* I proceed to honour overbought/oversold measures utilizing number bars to hold upward useful inward finding skillful merchandise location together with identifying short-term marketplace cycles. Below is a elementary rate-of-change mensurate using number bars, where each bar represents 500 cost changes inward the ES futures. Other number charts that I hold depict the bars on the the world of number of trades together with on the the world of book transacted. My nearly recent trend-following organization makes utilisation of number bars together with has done quite good identifying intraday swings. As of this writing, that organization enters SELL style below 1881 inward the March contract. The purchase together with sell parameters alter with each novel bar together with conform inward existent fourth dimension for marketplace volatility.

Monday, Feb 15th

* We tested the Jan lows this yesteryear week, but--as noted inward previous postings--breadth divergences were striking. Specifically, nosotros registered 1226 fresh three-month lows across all exchanges on Th together with 1353 novel lows on Monday. At the Jan bottom, nosotros saw 2663 stocks brand fresh three-month lows. Since that test, we've moved smartly higher on Fri together with thus i time again inward overnight trading. My short-term tendency model is solidly inward purchase style together with has been since Fri morning.

* An ongoing query projection has been assessing marketplace cycles yesteryear tracking the functioning of all NYSE stocks across a diversity of technical indicators. (Raw information from stockcharts.com). The mensurate below takes a volatility-weighted composite of purchase versus sell signals for ii technical systems: Bollinger Bands together with Parabolic SAR. Note that nosotros closed Fri at levels some those seen at intermediate-term bottoms together with create got quite a agency to become earlier nosotros run into overbought levels.

* Here is yet some other cycle based mensurate derived from breadth information (Raw information from indexindicators.com). Note that it is inward oversold territory, but non at levels seen at nearly intermediate-term lows together with good off overbought levels. If indeed nosotros create got seen a successful retest of Jan lows, I would hold off marketplace firmness to create got these cycle measures higher.

* I would position the greatest improvement to my trading every bit coming from focusing away from trends together with directional movement together with instead thinking of cycles together with the transitions from trending to mean-reverting demeanour together with dorsum again. Influenza A virus subtype H5N1 cycle includes phases of upward together with downward trending, every bit good every bit attain demeanour nigh highs together with lows. Identifying these transitions--and non getting caught upward inward whatsoever i stage of marketplace behavior--is really helpful to short-term trading.

No comments:

Post a Comment