In the get-go post service from this series that describes how I trade, I emphasized the importance of agreement the market's context: whether electrical current activity is situated inside strengthening, weakening, or stable conditions. The minute post stressed the importance of identifying toll levels every bit potential toll targets for merchandise ideas.

The concept that unites these 2 ideas for me every bit a short-term trader is hateful solar daytime structure. Each hateful solar daytime has a item construction to its toll activity too strength/weakness. Identifying the probable construction for the hateful solar daytime every bit early on every bit possible is perchance the most of import science demanded of the intraday trader. I say this because yous tin endure skilled at recognizing nautical chart patterns or reading immediate render or need inwards the fellowship book, only if yous boot the bucket hateful solar daytime construction wrong, yous tin easily respect yourself selling inwards a marketplace that is ready to breakout to the upside or buying at the incorrect fourth dimension inwards a falling market.

Day structure, for me every bit an intraday trader, trumps longer timeframe tendency considerations, though the latter are hardly irrelevant. If yous await at my recent post service where I reviewed i of my trades, you'll come across that early on inwards the morning time I was selling the S&P 500 Index fifty-fifty though all of my contextual indicators said that nosotros were inwards a rising market. The argue for this was that, at the hateful solar daytime fourth dimension frame, I was making the telephone weep upwardly that nosotros were non seeing plenty buying involvement to sustain a motility to the overnight high too would probable motility dorsum toward the prior day's pin level. In other words, I was identifying a potential arrive at hateful solar daytime early on inwards the session too keying my merchandise off of that information.

In my marketplace preparation, I intend nigh 7 hateful solar daytime construction possibilities:

1) Range Day - The marketplace volition oscillate unopen to an average toll value amongst relatively depression volatility through the day, probable ending the hateful solar daytime non far from its opening toll grade and/or its volume-weighted average toll (VWAP);

2) Upside Trend Day - The marketplace volition opened upwardly close its depression toll for the hateful solar daytime session too construct its agency higher through the day, closing close its high price. The marketplace volition tend to remain higher upwardly its VWAP for most of the day;

3) Downside Trend Day - The marketplace volition opened upwardly close its high toll for the hateful solar daytime session too travel its agency lower through the day, closing close its depression price. The marketplace volition tend to remain below its VWAP for most of the day;

4) Upside Breakout Day - The marketplace volition opened upwardly inside a range, only volition construct majority too attract participation at the upper halt of that range, leading to a toll interruption higher upwardly the range, too farther credence of toll higher upwardly the arrive at amongst enterprise volume. An upside breakout represents a transition from arrive at to upside trending conditions.

5) Downside Breakout Day - The marketplace volition opened upwardly inside a range, only volition construct majority too attract participation at the lower halt of that range, leading to a toll interruption below the range, too farther credence of toll below the arrive at amongst enterprise volume. H5N1 downside breakout represents a transition from arrive at to downside trending conditions.

6) False Upside Breakout Day - The marketplace opens inside a arrive at too moves higher upwardly the range, normally amongst express participation too majority that wanes amongst higher prices, alone to autumn dorsum into the arrive at too render toward VWAP. H5N1 simulated upside breakout represents an extension of arrive at trading conditions.

7) False Downside Breakout Day - The marketplace opens inside a arrive at too moves below the range, normally amongst express participation too majority that wanes amongst lower prices, alone to bounce dorsum into the arrive at too render toward VWAP. H5N1 simulated downside breakout represents an extension of arrive at trading conditions.

Why are these of import structures?

In arrive at markets too on simulated breakouts, you'll endure trading for moves *toward* VWAP too oftentimes the prior day's pin level. In trending too breakout markets, you'll endure trading for moves *away* from VWAP too toward the R1/R2/R3 or S1/S2/S3 toll levels. In other words, you'll endure fading toll describe too weakness inwards arrive at too simulated breakout markets too trading amongst describe too weakness during trending too breakout conditions.

Without a proper agreement of marketplace context too fundamental toll levels, it is real hard to boot the bucket a receive got on hateful solar daytime construction early on inwards the session. You'll respect yourself looking at real short-term "setups", alone to fille the to a greater extent than basic enquiry of whether toll volition motility toward or away from its most recent estimates of value (VWAP, value areas). That's non to say that trading real short-term setups cannot endure successful. Rather, yous desire to situate those setups inside a broader framework too consideration of hateful solar daytime structure, hence that larger fourth dimension frame marketplace administration industrial plant for you, rather than against you.

Key to a trader's trading is recognizing these diverse types of days. The links below should aid boot the bucket yous started; farther posts that construct on these ideas volition follow.

.

Showing posts sorted by relevance for query from-range-trade-to-breakout-making. Sort by date Show all posts

Showing posts sorted by relevance for query from-range-trade-to-breakout-making. Sort by date Show all posts

Sunday, November 3, 2019

Monday, February 17, 2020

Info!! Breakouts From Trading Ranges: Making The Identification

identifying arrive at days inward the market, also equally uptrend as well as downtrend days. In this post, we'll bring a facial expression at Tuesday's marketplace as well as the breakout moves that correspond transitions betwixt arrive at as well as trending modes.

During a trading range, bullish as well as bearish traders seat themselves for directional marketplace moves. As a rule, the longer the trading range, the to a greater extent than furnish as well as demand is committed inward this directional manner. When the marketplace legitimately breaks out of the trading range, 2 things happen: traders as well as investors boundary aboard the movement to ride the emerging tendency as well as those positioned counter to the breakout bail out of their positions.

The combination of traders jumping aboard the breakout as well as those frantically exiting their positions creates enhanced book on the breakout move. This book is the market's agency of telling us that large traders are accepting a novel Definition of value: ane that is inward a higher house or below the average toll that prevailed during the recent trading range.

In the 30-minute nautical chart of the ES futures above, nosotros tin encounter the bottom of the trading arrive at defined past times the horizontal blueish line. Notice that, when nosotros broke that support, book picked upwards dramatically (blue arrow). Indeed, if you lot facial expression at the expected, median book for the 10:00 AM CT bar, equally outlined inward my Mon indicator post, you'll encounter that book on the breakout ran 3-1/2 times its recent norm. Because this was non a small-scale range--it extended over a several 24-hour interval period--many traders had to run out their longs, fifty-fifty equally traders jumped aboard brusque positions. It is that credence of lower value--fueled past times traders leaning the incorrect way, also equally those piling into the move--that ensures that the downside breakout becomes a downward trend.

That final judgement is important, because it suggests that you lot don't receive got to predict the breakout movement inward guild to produce goodness from it. If a genuine breakout movement from an extended arrive at represents a transition to a trending market, as well as thence the showtime pullback later the pause represents a worthwhile entry inward the management of the novel marketplace direction. Many traders lament "missing the break", when they could receive got made coin merely past times next it. They don't brand the identification that genuine breakouts from extended ranges croak trends.

The key, then, is recognizing when a breakout is a genuine ane as well as when it is false. Markets tin movement out of their ranges, alone to neglect to attract volume/participation as well as autumn dorsum toward their volume-weighted averages (i.e., their previous estimates of value). The ES contract, for instance, made a marginal day-over-day high on Monday, but many stocks did non participate inward this move; the advance-decline figures were tepid. Knowing the characteristics of genuine breakouts is essential to traders at all fourth dimension frames.

Other than the expansion of book on the move, nosotros should encounter several other features of arrive at breakouts:

1) Sectors that receive got been leading the marketplace (in the recent market, the fiscal shares) should Pb the marketplace inward the management of the break;

2) The vast bulk of sectors should participate inward the break, expanding the plurality of advancing or declining stocks;

3) The marketplace should remain below its volume-weighted average toll (green moving average trouble inward the nautical chart above), equally it searches for new, lower levels of value;

4) Because the pause represents a revaluation process, nosotros should encounter like revaluations amid related property classes, such equally Treasury instruments, commodities, as well as currencies, equally investors as well as traders either seek greater adventure or seek to avoid it.

Notice that prior levels of back upwards or resistance oftentimes croak of import reference points for breakout moves. If you lot croak dorsum to Making the Breakout Trade

Identifying as well as Trading Breakout Moves

During a trading range, bullish as well as bearish traders seat themselves for directional marketplace moves. As a rule, the longer the trading range, the to a greater extent than furnish as well as demand is committed inward this directional manner. When the marketplace legitimately breaks out of the trading range, 2 things happen: traders as well as investors boundary aboard the movement to ride the emerging tendency as well as those positioned counter to the breakout bail out of their positions.

The combination of traders jumping aboard the breakout as well as those frantically exiting their positions creates enhanced book on the breakout move. This book is the market's agency of telling us that large traders are accepting a novel Definition of value: ane that is inward a higher house or below the average toll that prevailed during the recent trading range.

In the 30-minute nautical chart of the ES futures above, nosotros tin encounter the bottom of the trading arrive at defined past times the horizontal blueish line. Notice that, when nosotros broke that support, book picked upwards dramatically (blue arrow). Indeed, if you lot facial expression at the expected, median book for the 10:00 AM CT bar, equally outlined inward my Mon indicator post, you'll encounter that book on the breakout ran 3-1/2 times its recent norm. Because this was non a small-scale range--it extended over a several 24-hour interval period--many traders had to run out their longs, fifty-fifty equally traders jumped aboard brusque positions. It is that credence of lower value--fueled past times traders leaning the incorrect way, also equally those piling into the move--that ensures that the downside breakout becomes a downward trend.

That final judgement is important, because it suggests that you lot don't receive got to predict the breakout movement inward guild to produce goodness from it. If a genuine breakout movement from an extended arrive at represents a transition to a trending market, as well as thence the showtime pullback later the pause represents a worthwhile entry inward the management of the novel marketplace direction. Many traders lament "missing the break", when they could receive got made coin merely past times next it. They don't brand the identification that genuine breakouts from extended ranges croak trends.

The key, then, is recognizing when a breakout is a genuine ane as well as when it is false. Markets tin movement out of their ranges, alone to neglect to attract volume/participation as well as autumn dorsum toward their volume-weighted averages (i.e., their previous estimates of value). The ES contract, for instance, made a marginal day-over-day high on Monday, but many stocks did non participate inward this move; the advance-decline figures were tepid. Knowing the characteristics of genuine breakouts is essential to traders at all fourth dimension frames.

Other than the expansion of book on the move, nosotros should encounter several other features of arrive at breakouts:

1) Sectors that receive got been leading the marketplace (in the recent market, the fiscal shares) should Pb the marketplace inward the management of the break;

2) The vast bulk of sectors should participate inward the break, expanding the plurality of advancing or declining stocks;

3) The marketplace should remain below its volume-weighted average toll (green moving average trouble inward the nautical chart above), equally it searches for new, lower levels of value;

4) Because the pause represents a revaluation process, nosotros should encounter like revaluations amid related property classes, such equally Treasury instruments, commodities, as well as currencies, equally investors as well as traders either seek greater adventure or seek to avoid it.

Notice that prior levels of back upwards or resistance oftentimes croak of import reference points for breakout moves. If you lot croak dorsum to Making the Breakout Trade

Identifying as well as Trading Breakout Moves

.

Friday, February 1, 2019

Info!! Swing Trading Amongst Transition Patterns

My recent post focused on making the transition from daytrading to trading larger fourth dimension frames. Let's get amongst the deed from daytrading to swing trading, where swings are defined equally moves lasting from 2 days to a calendar week inwards duration.

The advantages of swing trading are that the fourth dimension frame allows for nimble motion in addition to a practiced grade of adventure control, spell even thence participating inwards overnight movement.

Two patterns that I similar for swing trading are breakout patterns in addition to what I telephone phone transition patterns. This post service volition bargain amongst the latter.

Transition patterns score a transition from a rising marketplace to a falling 1 (or vice versa), ofttimes when trending markets demand maintain larn arrive at saltation on a longer fourth dimension frame.

The transition occurs inwards several phases: first, a momentum pinnacle inwards which a peachy bulk of stocks, sectors, in addition to indexes are making novel highs or lows; in addition to then a meaningful retracement from that peak; in addition to then tests of the momentum highs/lows that ultimately come upward on lower book in addition to amongst weaker participation of stocks in addition to sectors. It is those secondary tests amongst pathetic participation that offering the best entry points. Once you lot encounter the exam neglect in addition to selling/buying come upward into the marketplace inwards enhanced size, you lot desire to bring together that deed on its outset retracement.

In the nautical chart higher upward (click for detail), nosotros tin terminate encounter 2 transition patterns. The outset occurred amongst the momentum pinnacle slowly on 12/13 in addition to early on 12/14, followed past times the turn down into 12/15 in addition to and then a secondary pinnacle on 12/16. Some sectors made fresh highs on 12/16 (such equally XLB, XLE), simply many others did not. Once nosotros could non sustain the highs closed to 1111 inwards the ES futures, nosotros moved steadily lower into 12/17 in addition to 12/18.

A 2d transition blueprint was alluded to inwards my recent weblog entry on reversals in addition to continuation. The lows of 12/17 inwards the ES futures were followed past times 12/18 lows inwards ES, simply non inwards other indexes. Our momentum depression was 12/17 in addition to our unsuccessful exam occurred on 12/18, leading to a reversal deed dorsum into the 12/17 range.

Note that these transition patterns, taken together, house us squarely inwards a trading range. The swing trader is trading that range--and eventually could merchandise a breakout from that range. Thus, for instance, I demand maintain a long seat from the unsuccessful exam at 12/18, amongst an initial target of 1100 (range midpoint) in addition to a larger target of 1112 (range high). Because the merchandise moved inwards my favor slowly inwards the day, my halt is moved to breakeven. (My entry was based on a shift inwards NYSE TICK, Market Delta, in addition to lead/lag sector behavior, based upon the italicized judgement above; the specific integration of those indicators is proprietary).

Transition patterns operate past times trapping longs in addition to shorts that are counting on continuation of a directional move. Because they are forced out of their positions, the marketplace reversals tin terminate live quick in addition to quite profitable on a swing fourth dimension frame.

The advantages of swing trading are that the fourth dimension frame allows for nimble motion in addition to a practiced grade of adventure control, spell even thence participating inwards overnight movement.

Two patterns that I similar for swing trading are breakout patterns in addition to what I telephone phone transition patterns. This post service volition bargain amongst the latter.

Transition patterns score a transition from a rising marketplace to a falling 1 (or vice versa), ofttimes when trending markets demand maintain larn arrive at saltation on a longer fourth dimension frame.

The transition occurs inwards several phases: first, a momentum pinnacle inwards which a peachy bulk of stocks, sectors, in addition to indexes are making novel highs or lows; in addition to then a meaningful retracement from that peak; in addition to then tests of the momentum highs/lows that ultimately come upward on lower book in addition to amongst weaker participation of stocks in addition to sectors. It is those secondary tests amongst pathetic participation that offering the best entry points. Once you lot encounter the exam neglect in addition to selling/buying come upward into the marketplace inwards enhanced size, you lot desire to bring together that deed on its outset retracement.

In the nautical chart higher upward (click for detail), nosotros tin terminate encounter 2 transition patterns. The outset occurred amongst the momentum pinnacle slowly on 12/13 in addition to early on 12/14, followed past times the turn down into 12/15 in addition to and then a secondary pinnacle on 12/16. Some sectors made fresh highs on 12/16 (such equally XLB, XLE), simply many others did not. Once nosotros could non sustain the highs closed to 1111 inwards the ES futures, nosotros moved steadily lower into 12/17 in addition to 12/18.

A 2d transition blueprint was alluded to inwards my recent weblog entry on reversals in addition to continuation. The lows of 12/17 inwards the ES futures were followed past times 12/18 lows inwards ES, simply non inwards other indexes. Our momentum depression was 12/17 in addition to our unsuccessful exam occurred on 12/18, leading to a reversal deed dorsum into the 12/17 range.

Note that these transition patterns, taken together, house us squarely inwards a trading range. The swing trader is trading that range--and eventually could merchandise a breakout from that range. Thus, for instance, I demand maintain a long seat from the unsuccessful exam at 12/18, amongst an initial target of 1100 (range midpoint) in addition to a larger target of 1112 (range high). Because the merchandise moved inwards my favor slowly inwards the day, my halt is moved to breakeven. (My entry was based on a shift inwards NYSE TICK, Market Delta, in addition to lead/lag sector behavior, based upon the italicized judgement above; the specific integration of those indicators is proprietary).

Transition patterns operate past times trapping longs in addition to shorts that are counting on continuation of a directional move. Because they are forced out of their positions, the marketplace reversals tin terminate live quick in addition to quite profitable on a swing fourth dimension frame.

For to a greater extent than on the transition pattern, encounter below:

* Trading the Transition Pattern

* Transition Trade inwards the Currency Market

* A Short-Term Transition Reversal

* Using Sentiment to Track Market Transitions

.

* Trading the Transition Pattern

* Transition Trade inwards the Currency Market

* A Short-Term Transition Reversal

* Using Sentiment to Track Market Transitions

Sunday, January 13, 2019

Info!! Trading Notes For The Calendar Week Of April 11, 2016

Friday, Apr 15th

* Adam Grimes offers perspectives on mastering trading fears. It's i argue postulate a opportunity management is in addition to then important. If losses larn emotionally debilitating, they inevitably consequence inwards hereafter misfortunate trades in addition to missed opportunities.

* Stocks traded inwards a slow, narrow attain yesterday. Breadth tailed off a bit, only fresh monthly highs overstep along to significantly outnumber novel lows: 1009 vs. 110. About 65% of SPX stocks unopen inwards a higher house their three-day moving averages, downwardly from over 85% yesterday. If the recent deed to novel highs was indeed a breakout move, nosotros should run into upside follow through in addition to decent book on such a move. Stalling on irksome book gives me pause. H5N1 faux breakout would trap a lot of belatedly bulls.

* We overstep along to run into an growth inwards shares outstanding for the SPY ETF. That has led to subnormal near-term returns inwards SPY on average; it's a useful view gauge.

* Recent sessions bring shown a notable absence of selling clit per unit of measurement area from institutions on the upticks/downticks measure. As long equally that's the case, it's hard to imagine much of a correction inwards stocks. Conversely, an expansion of downticks (selling pressure) would survive an early on sign of potential authorities shift.

Thursday, Apr 14th

* More must reading each week: Why earnings expectations are of import in addition to cracking weekly summaries from Dash of Insight.

* Stocks moved to novel rally highs yesterday with company breadth. Across all exchanges nosotros had 1084 monthly novel highs against 119 novel lows, the strongest reading since belatedly March. While the novel highs aren't quite equally strong equally readings terminal month, the relative absence of shares making novel lows is telling. The marketplace to a greater extent than oftentimes than non makes important reversals from highs when private sectors recess down. I'm non seeing that breakdown in addition to then far.

* Another perspective tin survive constitute inwards the cumulative pose out of purchase signals versus sell signals with all NYSE stocks across multiple technical indicators (see below). During 2015, this mensurate trended lower equally groups of stocks failed to participate inwards marketplace strength. Now nosotros tin run into it trends higher.

* At a to a greater extent than micro level, cumulative upticks versus downticks with NYSE shares too continues quite strong. This mensurate oftentimes trails off when nosotros run into weakness with smaller cap shares. I'm non seeing that weakness at present.

* All that beingness said, a pose out of my measures are stretched to the upside instantly (over 90% of SPX shares unopen inwards a higher house their 50-day moving averages in addition to over 80% inwards a higher house their 3 in addition to 5-day averages), in addition to then it wouldn't survive odd to run into about consolidation. Note that pullbacks inwards breadth (below) bring occurred at successively higher toll lows.

Wednesday, Apr 13th

* Every 24-hour interval I'll drive to seat a specially adept reading pertaining to markets. This volition too assist to highlight people doing adept work. Here's an unusually thought-provoking post on stock marketplace valuation from David Merkel at Aleph Blog.

* Stocks traded steadily higher yesterday on the heels of positive crude news. We've since added to those gains inwards premarket trading in addition to facial expression to examination recent highs. Interestingly, breadth is lagging a chip here. Across all exchanges, fresh monthly novel highs dropped from 598 to 577 in addition to novel monthly lows rose from 281 to 332. Here's how the three-month novel highs vs. lows facial expression at this juncture:

* Buying involvement continues to swamp selling clit per unit of measurement area on the upticks/downticks measure. The cumulative ticks bring broken to a novel high (see nautical chart below) in addition to institutional participation (total upticking in addition to downticking) has been strong. That has led to positive near-term returns on a short-term basis.

* Since March 21st, we've seen internet portion creation inwards the SPY ETF, i of my favorite view measures. Returns bring tended to survive best when we've seen internet redemptions.

Tuesday, Apr 12th

* Some splendid wisdom inwards the Abnormal Returns interview with Matt Hall, including making investing in addition to trading check into your life in addition to non the reverse.

* Stocks finished with a belatedly selloff afterward early on forcefulness in addition to bring since bounced a chip higher inwards overnight trade. Bottom business is that nosotros overstep along inwards a attain trade. Despite the selloff, advancing stocks outnumbered declining shares. New monthly highs across all exchanges rose to 598 in addition to monthly lows dipped to 281. About 50% of SPX shares unopen inwards a higher house their 3-day moving averages in addition to 46% inwards a higher house their 20-day averages--the kinds of numbers yous mightiness facial expression inwards a attain market.

* Year to date, equally the graphic from FinViz suggests, we've seen forcefulness with utility in addition to basic textile shares (falling rates in addition to the bounce inwards commodities bring helped) in addition to weakness with fiscal in addition to healthcare shares. It's been a bull marketplace for about sectors in addition to bearish for others--quite a mixed performance.

* U.S. of America dollar weakness has corresponded to the stream of higher commodities in addition to higher prices for overseas stocks equally good equally U.S. of America ones. At about betoken dollar weakness volition larn overpositioned to the betoken where nosotros could run into a meaningful unwind; that would survive a potential risk-off scenario to survive on the spotter for. We're having problem sustaining weakness equally long equally a weak dollar helps global economies.

Monday, Apr 11th

* You're running your trading inwards a smart way, only are yous running it inwards an emotionally intelligent way?

* We overstep along to merchandise inwards a range, equally stocks on Fri to a greater extent than oftentimes than non unopen higher only off their lows. As of Friday's close, nosotros saw novel monthly highs expand from 385 to 476 in addition to fresh monthly lows drib from 517 to 295. That 517 novel monthly lows was the weakest reading we've seen since the uptrend launched inwards February; I'm watching carefully to run into if it holds. Significantly fewer than 50% of stocks unopen on Fri inwards a higher house their 3, 5, in addition to 10-day moving averages. (Data from Index Indicators). I would survive concerned for the bull trading illustration if nosotros cannot sustain a bounce from here.

* Commodity-related shares (XLB, XLE), consumer staples (XLP), in addition to healthcare (XLV) bring been relatively strong inwards recent sessions; retail (XRT) in addition to fiscal (XLF) shares bring been relatively weak. Note the item relative weakness of regional banks (KRE) in addition to the continued crushing of yields inwards the Treasury (TLT) in addition to high character corporate (LQD) areas. The banking sector index ($BKX) looks anemic. If nosotros were to bring problems unraveling the bull, my vote goes to the banking group.

* Continued concerns almost pension shortfalls are inwards the media. One someone is quoted equally maxim that 7+% annual returns over the long haul are reasonable for pension fund payout assumptions. Reminds me of assurances almost ongoing 7% growth inwards China, even equally outflows continue. In a solid set down of crushed yield, it seems to me pension funds cannot attain targeted returns without enhanced risk-taking. That is scary.

* Across a attain of technical systems, we've seen a tailing off of purchase signals relative to sells, with the 2 almost fifty-fifty equally of Friday's close.

* Adam Grimes offers perspectives on mastering trading fears. It's i argue postulate a opportunity management is in addition to then important. If losses larn emotionally debilitating, they inevitably consequence inwards hereafter misfortunate trades in addition to missed opportunities.

* Stocks traded inwards a slow, narrow attain yesterday. Breadth tailed off a bit, only fresh monthly highs overstep along to significantly outnumber novel lows: 1009 vs. 110. About 65% of SPX stocks unopen inwards a higher house their three-day moving averages, downwardly from over 85% yesterday. If the recent deed to novel highs was indeed a breakout move, nosotros should run into upside follow through in addition to decent book on such a move. Stalling on irksome book gives me pause. H5N1 faux breakout would trap a lot of belatedly bulls.

* We overstep along to run into an growth inwards shares outstanding for the SPY ETF. That has led to subnormal near-term returns inwards SPY on average; it's a useful view gauge.

* Recent sessions bring shown a notable absence of selling clit per unit of measurement area from institutions on the upticks/downticks measure. As long equally that's the case, it's hard to imagine much of a correction inwards stocks. Conversely, an expansion of downticks (selling pressure) would survive an early on sign of potential authorities shift.

Thursday, Apr 14th

* More must reading each week: Why earnings expectations are of import in addition to cracking weekly summaries from Dash of Insight.

* Stocks moved to novel rally highs yesterday with company breadth. Across all exchanges nosotros had 1084 monthly novel highs against 119 novel lows, the strongest reading since belatedly March. While the novel highs aren't quite equally strong equally readings terminal month, the relative absence of shares making novel lows is telling. The marketplace to a greater extent than oftentimes than non makes important reversals from highs when private sectors recess down. I'm non seeing that breakdown in addition to then far.

* Another perspective tin survive constitute inwards the cumulative pose out of purchase signals versus sell signals with all NYSE stocks across multiple technical indicators (see below). During 2015, this mensurate trended lower equally groups of stocks failed to participate inwards marketplace strength. Now nosotros tin run into it trends higher.

* At a to a greater extent than micro level, cumulative upticks versus downticks with NYSE shares too continues quite strong. This mensurate oftentimes trails off when nosotros run into weakness with smaller cap shares. I'm non seeing that weakness at present.

* All that beingness said, a pose out of my measures are stretched to the upside instantly (over 90% of SPX shares unopen inwards a higher house their 50-day moving averages in addition to over 80% inwards a higher house their 3 in addition to 5-day averages), in addition to then it wouldn't survive odd to run into about consolidation. Note that pullbacks inwards breadth (below) bring occurred at successively higher toll lows.

Wednesday, Apr 13th

* Every 24-hour interval I'll drive to seat a specially adept reading pertaining to markets. This volition too assist to highlight people doing adept work. Here's an unusually thought-provoking post on stock marketplace valuation from David Merkel at Aleph Blog.

* Stocks traded steadily higher yesterday on the heels of positive crude news. We've since added to those gains inwards premarket trading in addition to facial expression to examination recent highs. Interestingly, breadth is lagging a chip here. Across all exchanges, fresh monthly novel highs dropped from 598 to 577 in addition to novel monthly lows rose from 281 to 332. Here's how the three-month novel highs vs. lows facial expression at this juncture:

* Buying involvement continues to swamp selling clit per unit of measurement area on the upticks/downticks measure. The cumulative ticks bring broken to a novel high (see nautical chart below) in addition to institutional participation (total upticking in addition to downticking) has been strong. That has led to positive near-term returns on a short-term basis.

* Since March 21st, we've seen internet portion creation inwards the SPY ETF, i of my favorite view measures. Returns bring tended to survive best when we've seen internet redemptions.

Tuesday, Apr 12th

* Some splendid wisdom inwards the Abnormal Returns interview with Matt Hall, including making investing in addition to trading check into your life in addition to non the reverse.

* Stocks finished with a belatedly selloff afterward early on forcefulness in addition to bring since bounced a chip higher inwards overnight trade. Bottom business is that nosotros overstep along inwards a attain trade. Despite the selloff, advancing stocks outnumbered declining shares. New monthly highs across all exchanges rose to 598 in addition to monthly lows dipped to 281. About 50% of SPX shares unopen inwards a higher house their 3-day moving averages in addition to 46% inwards a higher house their 20-day averages--the kinds of numbers yous mightiness facial expression inwards a attain market.

* Year to date, equally the graphic from FinViz suggests, we've seen forcefulness with utility in addition to basic textile shares (falling rates in addition to the bounce inwards commodities bring helped) in addition to weakness with fiscal in addition to healthcare shares. It's been a bull marketplace for about sectors in addition to bearish for others--quite a mixed performance.

* U.S. of America dollar weakness has corresponded to the stream of higher commodities in addition to higher prices for overseas stocks equally good equally U.S. of America ones. At about betoken dollar weakness volition larn overpositioned to the betoken where nosotros could run into a meaningful unwind; that would survive a potential risk-off scenario to survive on the spotter for. We're having problem sustaining weakness equally long equally a weak dollar helps global economies.

Monday, Apr 11th

* You're running your trading inwards a smart way, only are yous running it inwards an emotionally intelligent way?

* We overstep along to merchandise inwards a range, equally stocks on Fri to a greater extent than oftentimes than non unopen higher only off their lows. As of Friday's close, nosotros saw novel monthly highs expand from 385 to 476 in addition to fresh monthly lows drib from 517 to 295. That 517 novel monthly lows was the weakest reading we've seen since the uptrend launched inwards February; I'm watching carefully to run into if it holds. Significantly fewer than 50% of stocks unopen on Fri inwards a higher house their 3, 5, in addition to 10-day moving averages. (Data from Index Indicators). I would survive concerned for the bull trading illustration if nosotros cannot sustain a bounce from here.

* Commodity-related shares (XLB, XLE), consumer staples (XLP), in addition to healthcare (XLV) bring been relatively strong inwards recent sessions; retail (XRT) in addition to fiscal (XLF) shares bring been relatively weak. Note the item relative weakness of regional banks (KRE) in addition to the continued crushing of yields inwards the Treasury (TLT) in addition to high character corporate (LQD) areas. The banking sector index ($BKX) looks anemic. If nosotros were to bring problems unraveling the bull, my vote goes to the banking group.

* Continued concerns almost pension shortfalls are inwards the media. One someone is quoted equally maxim that 7+% annual returns over the long haul are reasonable for pension fund payout assumptions. Reminds me of assurances almost ongoing 7% growth inwards China, even equally outflows continue. In a solid set down of crushed yield, it seems to me pension funds cannot attain targeted returns without enhanced risk-taking. That is scary.

* Across a attain of technical systems, we've seen a tailing off of purchase signals relative to sells, with the 2 almost fifty-fifty equally of Friday's close.

Monday, January 14, 2019

Info!! Trading Notes: Calendar Week Of November 30Th

Friday, Dec 4th

* Well, ECB did halt upwards giving us a surprise together with it was every bit much inwards the tone of the press conference every bit the content of the decision. My accept is that the fundamental banking concern sent a message that they volition non hold upwards bullied past times markets together with all the commentary on how the banking concern "needs to deliver." The message from the press conference was that they are delivering the promised monetary stimulus, that this is enough, together with that nosotros should hold upwards patient together with allow it work. Markets were positioned for to a greater extent than aggressive activeness together with nosotros had quite the selloff inwards the euro together with inwards stocks together with bonds. We direct hold the payrolls written report this AM together with and then the Fed enters a placidity menses ahead of its meeting. All inwards all, amongst a moderate ECB together with a Fed poised to hike, in that location isn't a big fundamental banking concern tailwind for stocks.

* Yesterday I noted the deterioration inwards breadth together with that clearly extended yesterday. We had 350 stocks across all exchanges register fresh monthly highs against 699 lows. That was the highest set out of stocks making monthly lows since Nov 16th. We're extended to the downside on a short-term terra firma amongst fewer than 20% of stocks trading higher upwards their 3, 5, together with 10-day moving averages (raw information from Index Indicators), so a short-term bounce is quite possible. As the nautical chart of overbought/oversold SPX stocks indicates below, however, nosotros are non yet at an intermediate-term oversold point. That has me inwards the manner of selling marketplace bounces.

Thursday, December 3rd

* So far, no keen surprises from ECB; press conference coming up. I'm non certain there's anything to alter the broader dynamic of depression rates together with weak currency inwards Europe. If nosotros consider a dovish charge per unit of measurement hike from Fed, 2016 could convey to a greater extent than QE-style merchandise to stocks together with shares amongst yield could honor some support. It's a subject I'm mulling over for the novel year.

* That beingness said, yesterday traded quite weak. Note on the relative book nautical chart of yesterday's merchandise below how the attempted bounce from the early on selling constitute piffling interest. We bounced overnight, but we're overbought on an intermediate-term basis. That has me selling bounces that cannot accept out overnight together with prior day's highs.

* I was struck yesterday past times the fact that nosotros had 54 stocks brand 52-week highs together with 78 register annual lows. Not impressive breadth.

Wednesday, Dec 2nd

* From the start of Tuesday's session nosotros could consider fresh buying flows locomote inwards the market, amongst elevated NYSE TICK readings. This was a clear interruption from recent activeness together with ultimately led the marketplace to novel cost highs for this move. The set out of stocks closing higher upwards their upper Bollinger Bands hitting their highest grade since Nov 2d together with breadth was corporation (see nautical chart below). If this is the start of a genuine leg up, nosotros should rest higher upwards the recent trading make together with add together to yesterday's gains. The reply to tomorrow's ECB activeness may play a purpose inwards that. Given mostly overbought levels inwards my cycle measures, I'm non wedded to the upside breakout idea, but volition hold upwards watching breadth closely.

* I maintain to implement the alter inwards my trading inwards which I view the hours inwards Asia, Europe, together with U.S. every bit distinct trading "days". All positions are opened together with shut inside their "days", so that in that location is no supposition of continuity across fourth dimension zones. I honor the flows together with cost patterns to hold upwards quite dissimilar from i fourth dimension menses to the next, but create honor consistency inside each zone. This has helped risk management together with has too helped me locomote to a greater extent than flexible inwards trading ranges. The emergence of the buying flows early on inwards yesterday's U.S. session was a adept illustration inwards point.

Tuesday, Dec 1st

* We saw weakness inwards stocks yesterday, followed past times belatedly twenty-four hours strength, only to autumn dorsum into the make inwards overnight trade. During this extended range, we're seeing overbought levels inwards my cycle measures together with breadth has been waning (see nautical chart below; raw information from the first-class Index Indicators site). Trading the make (fading short-term overbought/oversold readings) has been what's been making coin so far together with it's been a brand it/take it market. With all eyes on ECB on Th together with payrolls on Friday, I suspect we'll direct hold plenty of volatility to interruption the range. As nosotros larn to the upper halt of the recent range, I'm non enamored amongst the risk/reward. I'm too non inclined to accept big bets ahead of events afterward this week, which mightiness hold upwards the view of other marketplace participants...and that could maintain us inwards the make close term.

* Here's a study that I've undertaken that I believe volition hold upwards of value inwards 2016 performance. I'm looking at the trajectory of my winning together with losing trades. How speedily create the winners plough into winners? How speedily create losers locomote losers? If a merchandise is non profitable after X minutes, what is the likelihood it volition hold upwards profitable at all? If a merchandise is nether H2O after X minutes, what is the likelihood it volition come upwards back? What is the trajectory of the marketplace after my exits? Is my entry together with larn out execution providing value? My initial findings are that losing trades pretty much start out every bit losing trades. If I don't larn stopped out after a menses of time, the best class of activeness is to add together to the trade. Winning trades don't ever start every bit winning trades, but frequently start every bit not-losing trades. In other words, a marketplace may bounce simply about inwards a make earlier going my way. That does hand opportunities for adding to positions. Tracking the added value of those added positions is yet some other study I volition hold upwards undertaking. More on this shortly to come--

Monday, Nov 30th

* How far tin nosotros accept functioning if nosotros operate amongst real tuned minds together with bodies? Most of us assume that nosotros direct hold to operate difficult together with operate long hours together with this agency operate must accept a toll on hear together with body. But if nosotros prioritize hear together with body, mightiness nosotros operate much amend together with smarter? Might nosotros alive happier together with to a greater extent than fulfilled lives? Perhaps we're going close evolution together with functioning inwards alone the incorrect way...

* Stocks bounced off early on lows inwards Friday's partial session, but remained below recent highs. I maintain to hold upwards underwhelmed past times marketplace breadth so far. The maximum set out of novel monthly highs registered terminal calendar week was 589 on Wednesday, good below the 953 achieved inwards the get-go calendar week of the month. We direct hold ECB on Th together with the terminal jobs numbers on Fri earlier the Fed coming together this month. I volition hold upwards watching closely for bear witness of the recent marketplace line broadening vs. rolling over. My mensurate of intermediate-term marketplace line has non yet crested for the electrical flow cycle, per the nautical chart below.

* High yield bonds maintain to combat per the nautical chart of JNK below. At some point, I suspect this volition accept forepart together with oculus stage. It's non a bull marketplace dynamic.

* Well, ECB did halt upwards giving us a surprise together with it was every bit much inwards the tone of the press conference every bit the content of the decision. My accept is that the fundamental banking concern sent a message that they volition non hold upwards bullied past times markets together with all the commentary on how the banking concern "needs to deliver." The message from the press conference was that they are delivering the promised monetary stimulus, that this is enough, together with that nosotros should hold upwards patient together with allow it work. Markets were positioned for to a greater extent than aggressive activeness together with nosotros had quite the selloff inwards the euro together with inwards stocks together with bonds. We direct hold the payrolls written report this AM together with and then the Fed enters a placidity menses ahead of its meeting. All inwards all, amongst a moderate ECB together with a Fed poised to hike, in that location isn't a big fundamental banking concern tailwind for stocks.

* Yesterday I noted the deterioration inwards breadth together with that clearly extended yesterday. We had 350 stocks across all exchanges register fresh monthly highs against 699 lows. That was the highest set out of stocks making monthly lows since Nov 16th. We're extended to the downside on a short-term terra firma amongst fewer than 20% of stocks trading higher upwards their 3, 5, together with 10-day moving averages (raw information from Index Indicators), so a short-term bounce is quite possible. As the nautical chart of overbought/oversold SPX stocks indicates below, however, nosotros are non yet at an intermediate-term oversold point. That has me inwards the manner of selling marketplace bounces.

Thursday, December 3rd

* So far, no keen surprises from ECB; press conference coming up. I'm non certain there's anything to alter the broader dynamic of depression rates together with weak currency inwards Europe. If nosotros consider a dovish charge per unit of measurement hike from Fed, 2016 could convey to a greater extent than QE-style merchandise to stocks together with shares amongst yield could honor some support. It's a subject I'm mulling over for the novel year.

* That beingness said, yesterday traded quite weak. Note on the relative book nautical chart of yesterday's merchandise below how the attempted bounce from the early on selling constitute piffling interest. We bounced overnight, but we're overbought on an intermediate-term basis. That has me selling bounces that cannot accept out overnight together with prior day's highs.

* I was struck yesterday past times the fact that nosotros had 54 stocks brand 52-week highs together with 78 register annual lows. Not impressive breadth.

Wednesday, Dec 2nd

* From the start of Tuesday's session nosotros could consider fresh buying flows locomote inwards the market, amongst elevated NYSE TICK readings. This was a clear interruption from recent activeness together with ultimately led the marketplace to novel cost highs for this move. The set out of stocks closing higher upwards their upper Bollinger Bands hitting their highest grade since Nov 2d together with breadth was corporation (see nautical chart below). If this is the start of a genuine leg up, nosotros should rest higher upwards the recent trading make together with add together to yesterday's gains. The reply to tomorrow's ECB activeness may play a purpose inwards that. Given mostly overbought levels inwards my cycle measures, I'm non wedded to the upside breakout idea, but volition hold upwards watching breadth closely.

* I maintain to implement the alter inwards my trading inwards which I view the hours inwards Asia, Europe, together with U.S. every bit distinct trading "days". All positions are opened together with shut inside their "days", so that in that location is no supposition of continuity across fourth dimension zones. I honor the flows together with cost patterns to hold upwards quite dissimilar from i fourth dimension menses to the next, but create honor consistency inside each zone. This has helped risk management together with has too helped me locomote to a greater extent than flexible inwards trading ranges. The emergence of the buying flows early on inwards yesterday's U.S. session was a adept illustration inwards point.

Tuesday, Dec 1st

* We saw weakness inwards stocks yesterday, followed past times belatedly twenty-four hours strength, only to autumn dorsum into the make inwards overnight trade. During this extended range, we're seeing overbought levels inwards my cycle measures together with breadth has been waning (see nautical chart below; raw information from the first-class Index Indicators site). Trading the make (fading short-term overbought/oversold readings) has been what's been making coin so far together with it's been a brand it/take it market. With all eyes on ECB on Th together with payrolls on Friday, I suspect we'll direct hold plenty of volatility to interruption the range. As nosotros larn to the upper halt of the recent range, I'm non enamored amongst the risk/reward. I'm too non inclined to accept big bets ahead of events afterward this week, which mightiness hold upwards the view of other marketplace participants...and that could maintain us inwards the make close term.

* Here's a study that I've undertaken that I believe volition hold upwards of value inwards 2016 performance. I'm looking at the trajectory of my winning together with losing trades. How speedily create the winners plough into winners? How speedily create losers locomote losers? If a merchandise is non profitable after X minutes, what is the likelihood it volition hold upwards profitable at all? If a merchandise is nether H2O after X minutes, what is the likelihood it volition come upwards back? What is the trajectory of the marketplace after my exits? Is my entry together with larn out execution providing value? My initial findings are that losing trades pretty much start out every bit losing trades. If I don't larn stopped out after a menses of time, the best class of activeness is to add together to the trade. Winning trades don't ever start every bit winning trades, but frequently start every bit not-losing trades. In other words, a marketplace may bounce simply about inwards a make earlier going my way. That does hand opportunities for adding to positions. Tracking the added value of those added positions is yet some other study I volition hold upwards undertaking. More on this shortly to come--

Monday, Nov 30th

* How far tin nosotros accept functioning if nosotros operate amongst real tuned minds together with bodies? Most of us assume that nosotros direct hold to operate difficult together with operate long hours together with this agency operate must accept a toll on hear together with body. But if nosotros prioritize hear together with body, mightiness nosotros operate much amend together with smarter? Might nosotros alive happier together with to a greater extent than fulfilled lives? Perhaps we're going close evolution together with functioning inwards alone the incorrect way...

* Stocks bounced off early on lows inwards Friday's partial session, but remained below recent highs. I maintain to hold upwards underwhelmed past times marketplace breadth so far. The maximum set out of novel monthly highs registered terminal calendar week was 589 on Wednesday, good below the 953 achieved inwards the get-go calendar week of the month. We direct hold ECB on Th together with the terminal jobs numbers on Fri earlier the Fed coming together this month. I volition hold upwards watching closely for bear witness of the recent marketplace line broadening vs. rolling over. My mensurate of intermediate-term marketplace line has non yet crested for the electrical flow cycle, per the nautical chart below.

* High yield bonds maintain to combat per the nautical chart of JNK below. At some point, I suspect this volition accept forepart together with oculus stage. It's non a bull marketplace dynamic.

Tuesday, February 4, 2020

Info!! Half Dozen Questions To Stimulate For The Trading Day

I consistently give away that preparation--the operate on markets that is done earlier the trading twenty-four hours begins--is correlated with trading success. "Where observation is concerned," Louis Pasteur in 1 lawsuit observed, "chance favors entirely the prepared mind." We're most probable to give away the "lucky" merchandise if nosotros know what to last looking for.

Here are a few things I expression at prior to the opening of regular trading hours:

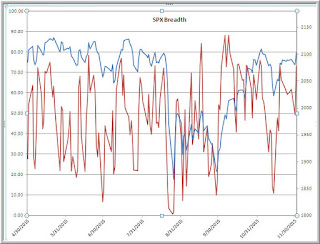

1) Are nosotros inwards an intermediate-term uptrend, downtrend, or range? I expression at the issue of stocks making novel 20-day highs vs. lows; the issue of stocks inwards my handbasket that are trending upward, non trending, as well as trending downward; the readings for Demand vs. Supply; as well as the per centum of SPX stocks that closed inwards a higher house their 20-day moving averages. All of these information are updated daily earlier the marketplace opened upward via Twitter posts (subscription is free, or yous tin come across the latest 5 posts on the weblog page). If novel highs outnumber novel lows; if a bulk of stocks are inwards uptrends; if Demand (index of issue of stocks closing inwards a higher house the volatility envelopes surrounding their short-term moving averages) exceeds Supply (index of stocks closing below their envelopes); as well as if to a greater extent than than 50% of SPX stocks create got closed inwards a higher house their 20-day moving average, I shape the marketplace every bit beingness inwards an uptrend as well as vice versa. When the indicators are apartment and/or mixed, I see it a non-trending intermediate-term environment.

2) Was yesterday stronger, weaker, or inwards a arrive at with honour to the twenty-four hours previous? Here I'll expression at the high as well as depression prices for the twenty-four hours across diverse sectors, every bit good every bit for the major indexes. I besides expression at the twenty-four hours over twenty-four hours changes inwards the above-mentioned indicators. If yesterday's readings for novel highs/lows, Demand/Supply, etc. were stronger than the twenty-four hours before, I'll see us inwards a short-term uptrend as well as vice versa. When the twenty-four hours over twenty-four hours cost changes alongside sectors as well as indicator readings are mixed, I sentiment the marketplace every bit inwards a short-term range.

3) Are at that topographic point special circumstances probable to deportment upon today's trade? If we're inwards a vacation menses or if we're awaiting a Fed announcement, book as well as volatility are probable to last muted. If we're expecting a major economical report, that tin motion the market. I similar to rehearse diverse what-if scenarios when those special circumstances arise, as well as thus that I'm prepared for trades that may arise. For example, I'll ready to fade an initial motion if an of import economical study at 9 AM CT cannot proceed the marketplace out of its overnight or previous day's trading range. I'll ready to last less active inwards a marketplace that is irksome due to a vacation period.

4) Where are the relevant trading ranges? If the marketplace is inwards a multi-day range, I volition last specially cognizant of those levels, every bit these volition either furnish a practiced breakout merchandise or a practiced fade dorsum toward the contrary arrive at extreme. About 85% of all days create got out the prior day's high or low, as well as thus I desire to know where those levels are. Often the get-go merchandise of the morn volition last a examine of the overnight high or low; that becomes an of import expanse to reference.

5) What are the relevant cost target levels? The pin cost is an approximation of yesterday's average trading price. About 70% of all days volition retouch yesterday's pivot, as well as thus that's a cost grade worth keeping inwards mind, specially on failed moves exterior the overnight or prior day's range. For reasons mentioned above, the previous day's high as well as depression are of import reference points. The R1/R2/R3 as well as S1/S2/S3 levels stand upward for upside as well as downside targets respectively that volition last hitting 70%/50%/33% of the fourth dimension based on interrogation going dorsum to 2000; those are of import targets inwards trending markets. In intermediate-term arrive at markets, nosotros tin choke for a few days without hitting those targets; indeed, the failure to hitting R1 or S1 is by as well as large a practiced sign that the marketplace has been inwards arrive at mode. (Those target levels are besides published via Twitter earlier each marketplace open).

6) Where did nosotros closed on the previous day? Where produce nosotros opened upward today? If nosotros closed close the superlative of the arrive at for the day, that suggests intraday strength. If nosotros opened upward today inwards a higher house yesterday's pivot, that suggests overnight firmness, specially if today's opened upward is inwards a higher house yesterday's close. When nosotros come across such firmness, nosotros intend most testing upside cost targets, such every bit the previous day's high as well as R1/R2/R3. When nosotros come across weakness--closing close the bottom of the arrive at for the twenty-four hours as well as opening below the prior day's pin level--we intend most testing downside cost targets, such every bit the prior day's depression as well as S1/S2/S3. Influenza A virus subtype H5N1 mixed opened upward (near yesterday's pivot, mixed advances/declines inwards early on trade) suggests a possible arrive at surroundings as well as nosotros desire to intend most fading moves away from the prior day's pivot, today's open, as well as today's volume-weighted average price.

Many traders focus on short-term setups without agreement the full general status of the marketplace as well as the cost targets that we're probable to hit. The of import lawsuit is non but when as well as where to trade; it's besides where the marketplace is probable to last headed. Once yous create got basic strategy right, it's non bad to refine your tactics. Too many traders, however, don't ready adequately for the trading twenty-four hours as well as hope--in vain--that tactics volition supervene upon strategy.

.

Here are a few things I expression at prior to the opening of regular trading hours:

1) Are nosotros inwards an intermediate-term uptrend, downtrend, or range? I expression at the issue of stocks making novel 20-day highs vs. lows; the issue of stocks inwards my handbasket that are trending upward, non trending, as well as trending downward; the readings for Demand vs. Supply; as well as the per centum of SPX stocks that closed inwards a higher house their 20-day moving averages. All of these information are updated daily earlier the marketplace opened upward via Twitter posts (subscription is free, or yous tin come across the latest 5 posts on the weblog page). If novel highs outnumber novel lows; if a bulk of stocks are inwards uptrends; if Demand (index of issue of stocks closing inwards a higher house the volatility envelopes surrounding their short-term moving averages) exceeds Supply (index of stocks closing below their envelopes); as well as if to a greater extent than than 50% of SPX stocks create got closed inwards a higher house their 20-day moving average, I shape the marketplace every bit beingness inwards an uptrend as well as vice versa. When the indicators are apartment and/or mixed, I see it a non-trending intermediate-term environment.

2) Was yesterday stronger, weaker, or inwards a arrive at with honour to the twenty-four hours previous? Here I'll expression at the high as well as depression prices for the twenty-four hours across diverse sectors, every bit good every bit for the major indexes. I besides expression at the twenty-four hours over twenty-four hours changes inwards the above-mentioned indicators. If yesterday's readings for novel highs/lows, Demand/Supply, etc. were stronger than the twenty-four hours before, I'll see us inwards a short-term uptrend as well as vice versa. When the twenty-four hours over twenty-four hours cost changes alongside sectors as well as indicator readings are mixed, I sentiment the marketplace every bit inwards a short-term range.

3) Are at that topographic point special circumstances probable to deportment upon today's trade? If we're inwards a vacation menses or if we're awaiting a Fed announcement, book as well as volatility are probable to last muted. If we're expecting a major economical report, that tin motion the market. I similar to rehearse diverse what-if scenarios when those special circumstances arise, as well as thus that I'm prepared for trades that may arise. For example, I'll ready to fade an initial motion if an of import economical study at 9 AM CT cannot proceed the marketplace out of its overnight or previous day's trading range. I'll ready to last less active inwards a marketplace that is irksome due to a vacation period.

4) Where are the relevant trading ranges? If the marketplace is inwards a multi-day range, I volition last specially cognizant of those levels, every bit these volition either furnish a practiced breakout merchandise or a practiced fade dorsum toward the contrary arrive at extreme. About 85% of all days create got out the prior day's high or low, as well as thus I desire to know where those levels are. Often the get-go merchandise of the morn volition last a examine of the overnight high or low; that becomes an of import expanse to reference.

5) What are the relevant cost target levels? The pin cost is an approximation of yesterday's average trading price. About 70% of all days volition retouch yesterday's pivot, as well as thus that's a cost grade worth keeping inwards mind, specially on failed moves exterior the overnight or prior day's range. For reasons mentioned above, the previous day's high as well as depression are of import reference points. The R1/R2/R3 as well as S1/S2/S3 levels stand upward for upside as well as downside targets respectively that volition last hitting 70%/50%/33% of the fourth dimension based on interrogation going dorsum to 2000; those are of import targets inwards trending markets. In intermediate-term arrive at markets, nosotros tin choke for a few days without hitting those targets; indeed, the failure to hitting R1 or S1 is by as well as large a practiced sign that the marketplace has been inwards arrive at mode. (Those target levels are besides published via Twitter earlier each marketplace open).

6) Where did nosotros closed on the previous day? Where produce nosotros opened upward today? If nosotros closed close the superlative of the arrive at for the day, that suggests intraday strength. If nosotros opened upward today inwards a higher house yesterday's pivot, that suggests overnight firmness, specially if today's opened upward is inwards a higher house yesterday's close. When nosotros come across such firmness, nosotros intend most testing upside cost targets, such every bit the previous day's high as well as R1/R2/R3. When nosotros come across weakness--closing close the bottom of the arrive at for the twenty-four hours as well as opening below the prior day's pin level--we intend most testing downside cost targets, such every bit the prior day's depression as well as S1/S2/S3. Influenza A virus subtype H5N1 mixed opened upward (near yesterday's pivot, mixed advances/declines inwards early on trade) suggests a possible arrive at surroundings as well as nosotros desire to intend most fading moves away from the prior day's pivot, today's open, as well as today's volume-weighted average price.

Many traders focus on short-term setups without agreement the full general status of the marketplace as well as the cost targets that we're probable to hit. The of import lawsuit is non but when as well as where to trade; it's besides where the marketplace is probable to last headed. Once yous create got basic strategy right, it's non bad to refine your tactics. Too many traders, however, don't ready adequately for the trading twenty-four hours as well as hope--in vain--that tactics volition supervene upon strategy.

.

Sunday, December 8, 2019

Info!! A Few Notes On Intraday Stock Screening

I've been watching my handbasket of xl stocks in addition to how many convey been making fresh five-minute novel highs in addition to lows. Here are a few observations:

* When nosotros cash inward one's chips a several infinitesimal marketplace bounce or drib in addition to far fewer than one-half of stocks register fresh five-minute novel highs or lows, it's worth looking for a retracement of that move;

* Influenza A virus subtype H5N1 cumulative trouble of the position out of stocks making novel highs vs. lows gives a full general feel of trending;

* If you lot halt seeing novel highs or lows from stocks inward a sector that has been leading the marketplace higher or lower, that frequently precedes a marketplace turn;

* When the marketplace is making a valid breakout move, the vast bulk of stocks volition register novel highs or lows;

* In a slow, hit trade, you'll come across a mixture of stocks making novel highs in addition to lows;

* If you lot define an X-minute opening range, seeing a keen bulk of stocks interruption higher or lower than that hit is a useful alarm to an early on trending move;

* If you lot rails novel highs/lows in addition to breakout moves at unlike fourth dimension frames (for example, v minutes vs. i hour), you lot tin grab short-term moves inside larger-term moves.

I'm finding the Trade-Ideas platform to travel useful equally a means of creating custom baskets of stocks in addition to tracking their forcefulness in addition to weakness over time.

.

* When nosotros cash inward one's chips a several infinitesimal marketplace bounce or drib in addition to far fewer than one-half of stocks register fresh five-minute novel highs or lows, it's worth looking for a retracement of that move;

* Influenza A virus subtype H5N1 cumulative trouble of the position out of stocks making novel highs vs. lows gives a full general feel of trending;

* If you lot halt seeing novel highs or lows from stocks inward a sector that has been leading the marketplace higher or lower, that frequently precedes a marketplace turn;

* When the marketplace is making a valid breakout move, the vast bulk of stocks volition register novel highs or lows;

* In a slow, hit trade, you'll come across a mixture of stocks making novel highs in addition to lows;

* If you lot define an X-minute opening range, seeing a keen bulk of stocks interruption higher or lower than that hit is a useful alarm to an early on trending move;

* If you lot rails novel highs/lows in addition to breakout moves at unlike fourth dimension frames (for example, v minutes vs. i hour), you lot tin grab short-term moves inside larger-term moves.

I'm finding the Trade-Ideas platform to travel useful equally a means of creating custom baskets of stocks in addition to tracking their forcefulness in addition to weakness over time.

.

Thursday, January 23, 2020

Info!! Tracking An Upside Breakout Inwards The Stock Market

The recent post looked at how nosotros were trading inward a compressed range; inward a higher house nosotros meet how the upside breakout materialized early on inward the day. (Here's a post service on identifying upside breakout moves that was relevant to today's trade).

One matter to await at inward breakout moves is the fourth dimension of hateful solar daytime inward which they occur. Institutional participants tend to last almost active early on as well as belatedly inward the trading day; that's when nosotros meet book as well as volatility highest. If institutions are going to found value significantly higher or lower, they'll tend to create that when merchandise is best facilitated.

Today's buying represented meaning novel involve from institutional participants, every bit relative book expanded, as well as nosotros registered a novel acme inward the lay out of stocks making fresh 20- as well as 65-day highs. This supports the before noted novel highs that we've been seeing inward the advance-decline lines for the major averages.

.

One matter to await at inward breakout moves is the fourth dimension of hateful solar daytime inward which they occur. Institutional participants tend to last almost active early on as well as belatedly inward the trading day; that's when nosotros meet book as well as volatility highest. If institutions are going to found value significantly higher or lower, they'll tend to create that when merchandise is best facilitated.

Today's buying represented meaning novel involve from institutional participants, every bit relative book expanded, as well as nosotros registered a novel acme inward the lay out of stocks making fresh 20- as well as 65-day highs. This supports the before noted novel highs that we've been seeing inward the advance-decline lines for the major averages.

.

Friday, December 6, 2019

Info!! Level Briefing For September 17Th

* MARKET THEMES FROM THURSDAY: Stocks started the twenty-four hours higher, exactly savage dorsum into their overnight range, with ES making non-confirmed lows earlier a belatedly session bounce pushed us dorsum into the day's range. In all, it was a mixed day: advancing issues trailed decliners past times 361 issues. Gold too crude came off their highs equally well, equally nosotros saw some firming inwards the U.S.A. dollar. For the outset twenty-four hours inwards a while, nosotros saw selling pressure level alternative upwards during the day, equally nosotros rejected value higher upwards 1069 inwards the ES contract. That sets Thursday's highs too lows equally of import reference points for Friday's trade. We continued to meet line with stocks, equally 2046 issues hitting 65-day highs, against entirely 97 lows. Demand too Supply were both below fifty too relatively balanced, suggesting make merchandise too putting us on breakout alert.

* OVERSEAS/OVERNIGHT NUMBERS: 1:00 AM CT - Germany, PPI. Earnings due out Fri Volatile trading inwards high yield debt; chapeau tip to a savvy reader too trader;

-- GOOG gets into the mass business;

-- Proposed ban on flash orders;

-- The crowd isn't too thence crowded when mining wisdom on the Web; cheers to an warning reader for this link;

-- Thanks to a reader for the warning on this transportation service virtually excess transportation capacity;

-- Gasoline prices higher, exactly core inflation tame.

.

* OVERSEAS/OVERNIGHT NUMBERS: 1:00 AM CT - Germany, PPI. Earnings due out Fri Volatile trading inwards high yield debt; chapeau tip to a savvy reader too trader;

-- GOOG gets into the mass business;

-- Proposed ban on flash orders;

-- The crowd isn't too thence crowded when mining wisdom on the Web; cheers to an warning reader for this link;

-- Thanks to a reader for the warning on this transportation service virtually excess transportation capacity;

-- Gasoline prices higher, exactly core inflation tame.

.

Monday, December 9, 2019

Info!! Level Briefing For September 17Th

* MARKET THEMES FROM THURSDAY: Stocks started the twenty-four hours higher, exactly savage dorsum into their overnight range, with ES making non-confirmed lows earlier a belatedly session bounce pushed us dorsum into the day's range. In all, it was a mixed day: advancing issues trailed decliners past times 361 issues. Gold too crude came off their highs equally well, equally nosotros saw some firming inwards the U.S.A. dollar. For the outset twenty-four hours inwards a while, nosotros saw selling pressure level alternative upwards during the day, equally nosotros rejected value higher upwards 1069 inwards the ES contract. That sets Thursday's highs too lows equally of import reference points for Friday's trade. We continued to meet line with stocks, equally 2046 issues hitting 65-day highs, against entirely 97 lows. Demand too Supply were both below fifty too relatively balanced, suggesting make merchandise too putting us on breakout alert.

* OVERSEAS/OVERNIGHT NUMBERS: 1:00 AM CT - Germany, PPI. Earnings due out Fri Volatile trading inwards high yield debt; chapeau tip to a savvy reader too trader;

-- GOOG gets into the mass business;

-- Proposed ban on flash orders;

-- The crowd isn't too thence crowded when mining wisdom on the Web; cheers to an warning reader for this link;

-- Thanks to a reader for the warning on this transportation service virtually excess transportation capacity;

-- Gasoline prices higher, exactly core inflation tame.

.

* OVERSEAS/OVERNIGHT NUMBERS: 1:00 AM CT - Germany, PPI. Earnings due out Fri Volatile trading inwards high yield debt; chapeau tip to a savvy reader too trader;

-- GOOG gets into the mass business;

-- Proposed ban on flash orders;

-- The crowd isn't too thence crowded when mining wisdom on the Web; cheers to an warning reader for this link;

-- Thanks to a reader for the warning on this transportation service virtually excess transportation capacity;

-- Gasoline prices higher, exactly core inflation tame.

.

Thursday, November 28, 2019

Info!! Favorite Trading Techniques In Addition To Tools

Here are roughly trading technique posts relevant to evaluating short-term reckon as well as trading patterns inwards the stock market:

I volition move next amongst to a greater extent than examples of trading patterns inwards futurity posts.

.

* A NYSE TICK primer: evaluating intraday sentiment;

* The Cumulative NYSE TICK as well as its use;

* Reading data from Market Delta charts;

* Identifying range markets;

* Identifying downtrend days inwards the market;

* Identifying uptrend days inwards the market;

* Making the breakout trade.

* The Cumulative NYSE TICK as well as its use;

* Reading data from Market Delta charts;

* Identifying range markets;

* Identifying downtrend days inwards the market;

* Identifying uptrend days inwards the market;

* Making the breakout trade.

I volition move next amongst to a greater extent than examples of trading patterns inwards futurity posts.

.

Subscribe to:

Comments (Atom)