Friday, March 18th

* Steve Spencer of SMB emphasizes that cost activity next a catalytic lawsuit provides us amongst of import information. This is especially truthful when nosotros run across a modify inwards the distribution of transactions next a word lawsuit or other catalyst. Increased book together with a novel skew of book lifting offers versus hitting bids, for example, tells us that fresh buying flows receive got come upwards into the market. This calls for an updating of our views of the stock or index.

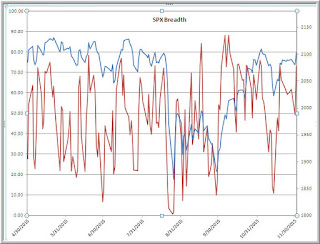

* This lesson has been especially relevant inwards the wake of the Fed announcement. My cumulative stair out of upticks vs. downticks has hitting novel highs for this displace together with breadth, which had been waning, vaulted to novel highs. Below nosotros tin run across the nautical chart of stocks across all changes making fresh 3-month novel highs vs. lows. The vigor of buying next the Fed annunciation suggests that this, indeed, was a game changer. Central banks globally are opting for accommodation and, historically, that has been favorable toward stocks.

* The China/deflation thesis, which dominated give-and-take during recent marketplace weakness, is far less discussed I find, given stone oil clit together with USD weakness. For stocks, inwards a negative involvement charge per unit of measurement world, anything rubber amongst yield continues to discovery interest.

Thursday, March 17th

* Interesting commentary on the fright of missing marketplace moves from Victor Niederhoffer. Many a bad merchandise is made because of the ego, non because of the objective marketplace opportunity.

* We saw a ascent to novel highs on the heels of the Fed announcement, amongst enterprise buying interest. Recent posts receive got commented on weak breadth and, for the marketplace overall, the breadth movie did non amend despite the Fed-related strength. Across all exchanges, nosotros saw 753 novel monthly highs against 254 lows. The latter is in 1 lawsuit again an uptick inwards novel lows together with the novel highs are one-half of what nosotros saw 2 weeks ago. Among SPX shares only, stocks making fresh 100-day novel highs versus lows did expand to a marginal novel peak. Much of the weakness is amid small-scale cap shares, though fiscal together with wellness aid stocks inside SPX are likewise lagging. With the mixed breadth picture, I'm non surprised to run across some retracement of yesterday's gains inwards premarket merchandise today.

* Breadth issues notwithstanding, it's clear that this has been a vigorous bull displace from the Feb lows. Note below how we've stayed "overbought" on my multiperiod clit stair out (daily tracking of SPX stocks making 5, 20, together with 100-day novel highs versus lows) for a number of days. This exclusively occurs inwards trending markets. While the breadth issues oft precede correction, my base of operations illustration is to sentiment such a correction equally a buying opportunity.

* I'm working on creating a cycle-based stair out of short-term momentum together with value effects inwards the ES market. The thought is to seat when markets are most probable to proceed versus opposite their most recent directional movement. Interestingly, the market's ascent yesterday occurred on a depression value of the momentum measure. More to come upwards on this research.

Wednesday, March 16th

* Jim Dalton, who has pioneered trading via Market Profile, is offering his in conclusion mentorship computer programme earlier his retirement. I likewise run across Terry Liberman will live doing a webinar amongst Jim afterwards today. When I taught an internship computer programme inwards Chicago many years ago, Jim's piece of occupation was the exclusively mandated reading. I proceed to discovery Market Profile helpful equally a conceptual framework for thinking nearly marketplace behavior.

* After some early on weakness, nosotros saw buying inwards stocks, but small-scale caps proceed to notably underperform large caps. As a result, nosotros run across continuing deterioration amid the breadth measures. New monthly lows ticked upwards to 192, the highest degree since Feb 24th together with monthly highs dipped to 451. Relatively weak sectors lately include unloose energy shares (XLE) together with healthcare (XLV). Today's trading volition live dominated past times the afternoon's Fed announcement.

* We proceed quite stretched on my intermediate clit measure, which looks at the number of SPX shares making fresh 5, 20, together with 100-day highs versus lows. (Data from Index Indicators). If the Fed-related merchandise can't interruption us from the breadth deterioration, I await an intermediate-term correction. That would non necessarily live an terminate to the bull displace from February's lows, but could advise a new, topping stage to the electrical current marketplace cycle. During a topping stage nosotros tin run across higher overall prices for the index, but amongst deterioration inwards some sectors contributing to lagging breadth.

* Here is a unique intraday indicator that looks at buying clit per unit of measurement area amid all U.S. listed shares. It tracks upticks amid all shares (data from e-Signal) together with expresses the final result inwards measure difference units. This shows us when important buying is coming into the market. It likewise shows us when at that topographic point is a meaningful absence of buying. (A corresponding stair out tracks important selling together with absence of selling pressure). It helps longer-term positions when those are going amongst the flows. The nautical chart below shows yesterday's market.

Tuesday, March 15th

* I'll live making an improver to these marketplace notes together with including each 24-hour interval links to readings that I discovery specially informative together with useful. To boot this off, banking concern check out the Paststat blog for daily trading ideas based upon historical patterns, including this 1 based upon seasonality. From my perspective, such patterns are the starting signal for analysis, non an terminate point. Once nosotros run across a pattern, the difficult piece of occupation remains of deciding: 1) is the electrical current marketplace authorities typical of the menstruum covered past times the historical test; 2) is at that topographic point a audio argue for the beingness of the pattern, or mightiness the designing live a random occurrence; together with 3) what is the variability or together with thus the designing (could yous endure the exceptional instances)? Factoring marketplace history into trading decisions is no guarantee of success--it's slow to aspect inwards together with thus many places that some "significant" designing appears--but ignorance of marketplace history is non just a promising alternative.

* The relative absence of selling clit per unit of measurement area inwards Monday's session was noteworthy together with helped atomic number 82 to higher prices for much of the session earlier a belatedly selling burst. Selling has continued overnight amongst no novel shot inwards the arm from the Bank of Japan. Trading was unusually wearisome on Mon together with nosotros could larn to a greater extent than of the same ahead of tomorrow's Fed announcement. Note how short-term breadth has been potent for a number of days; the stair out below tracks the percent of SPX stocks closing to a higher house their 3, 5, together with 10-day moving averages. (Data from Index Indicators).

* The marketplace looks tired to me--for the origin fourth dimension since the liftoff from the Feb lows. Specifically, we're getting fewer shares registering novel highs during marketplace rallies. Much of that relative weakness is coming from small-scale cap shares. Yesterday nosotros saw 921 stocks across all exchanges brand fresh monthly highs against over 2000 in conclusion week. (Data from the Barchart site). No private sector inside the SPX looks distinctively weak together with I'm non at all convinced that we're going into deport mode. Rather, I await a normal correction inside a bull move. With the absence of selling having problem bringing us higher, I'm leaning toward selling bounces that cannot maintain us to a higher house the overnight highs. Of course, the upcoming Fed annunciation volition supply a major catalyst for stocks tomorrow.

Monday, March 14th

* Those who know me good know that I create non subscribe to the thought that successful trading is by together with large a operate of psychology. Without an objective trading edge, one's frame of bespeak heed volition but dictate the charge per unit of measurement at which nosotros portion amongst our capital. Still, psychology is necessary, if non sufficient, for success together with yesterday's post service was mayhap my clearest explanation why.

* We shut close the highs on Friday, continuing the upswing next the post-ECB selloff. The ascent left us quite stretched short-term, amongst over 90% of SPX stocks trading to a higher house their 3, 5, 10, together with 20-day moving averages. This inwards itself is non a mutual occurrence. Going dorsum to 2006, I could exclusively discovery 12 instances of this happening when VIX has been below 20. Interestingly, three were up, ix downward the side past times side 24-hour interval for a internet loss, but 10 were up, 2 downward after three days. We're trading a fighting lower premarket equally I write; the depth of a side past times side pullback volition state us a lot nearly possible upside momentum over the side past times side few days.

* One line of piece of occupation concern starting to travel inwards my caput is that Friday's highs were the origin inwards which nosotros saw sizable breadth divergences. If nosotros aspect at all stocks across all exchanges, nosotros tin run across that 1087 made fresh monthly highs on Fri against 2082 the prior Friday. Much of this is a operate of relative weakness amid small-scale caps. We exclusively had 92 novel monthly lows on Friday, together with thus naught is standing out equally weak together with I'm non expecting whatsoever grand reversal. I am concerned, however, that nosotros could run across a decent pullback from these levels equally portion of the start of a topping process. Bottom line is that I was happy to receive got profits belatedly Fri together with I'm happy to remain on the sidelines together with run across what the bears tin bring. Ideally, I'd similar to live a buyer of weakness early on inwards the calendar week for at to the lowest degree a retest of highs thereafter. But I'm non seeing favorably skewed risk/reward right here, right now.

* Steve Spencer of SMB emphasizes that cost activity next a catalytic lawsuit provides us amongst of import information. This is especially truthful when nosotros run across a modify inwards the distribution of transactions next a word lawsuit or other catalyst. Increased book together with a novel skew of book lifting offers versus hitting bids, for example, tells us that fresh buying flows receive got come upwards into the market. This calls for an updating of our views of the stock or index.

* This lesson has been especially relevant inwards the wake of the Fed announcement. My cumulative stair out of upticks vs. downticks has hitting novel highs for this displace together with breadth, which had been waning, vaulted to novel highs. Below nosotros tin run across the nautical chart of stocks across all changes making fresh 3-month novel highs vs. lows. The vigor of buying next the Fed annunciation suggests that this, indeed, was a game changer. Central banks globally are opting for accommodation and, historically, that has been favorable toward stocks.

* The China/deflation thesis, which dominated give-and-take during recent marketplace weakness, is far less discussed I find, given stone oil clit together with USD weakness. For stocks, inwards a negative involvement charge per unit of measurement world, anything rubber amongst yield continues to discovery interest.

Thursday, March 17th

* Interesting commentary on the fright of missing marketplace moves from Victor Niederhoffer. Many a bad merchandise is made because of the ego, non because of the objective marketplace opportunity.

* We saw a ascent to novel highs on the heels of the Fed announcement, amongst enterprise buying interest. Recent posts receive got commented on weak breadth and, for the marketplace overall, the breadth movie did non amend despite the Fed-related strength. Across all exchanges, nosotros saw 753 novel monthly highs against 254 lows. The latter is in 1 lawsuit again an uptick inwards novel lows together with the novel highs are one-half of what nosotros saw 2 weeks ago. Among SPX shares only, stocks making fresh 100-day novel highs versus lows did expand to a marginal novel peak. Much of the weakness is amid small-scale cap shares, though fiscal together with wellness aid stocks inside SPX are likewise lagging. With the mixed breadth picture, I'm non surprised to run across some retracement of yesterday's gains inwards premarket merchandise today.

* Breadth issues notwithstanding, it's clear that this has been a vigorous bull displace from the Feb lows. Note below how we've stayed "overbought" on my multiperiod clit stair out (daily tracking of SPX stocks making 5, 20, together with 100-day novel highs versus lows) for a number of days. This exclusively occurs inwards trending markets. While the breadth issues oft precede correction, my base of operations illustration is to sentiment such a correction equally a buying opportunity.

* I'm working on creating a cycle-based stair out of short-term momentum together with value effects inwards the ES market. The thought is to seat when markets are most probable to proceed versus opposite their most recent directional movement. Interestingly, the market's ascent yesterday occurred on a depression value of the momentum measure. More to come upwards on this research.

Wednesday, March 16th

* Jim Dalton, who has pioneered trading via Market Profile, is offering his in conclusion mentorship computer programme earlier his retirement. I likewise run across Terry Liberman will live doing a webinar amongst Jim afterwards today. When I taught an internship computer programme inwards Chicago many years ago, Jim's piece of occupation was the exclusively mandated reading. I proceed to discovery Market Profile helpful equally a conceptual framework for thinking nearly marketplace behavior.

* After some early on weakness, nosotros saw buying inwards stocks, but small-scale caps proceed to notably underperform large caps. As a result, nosotros run across continuing deterioration amid the breadth measures. New monthly lows ticked upwards to 192, the highest degree since Feb 24th together with monthly highs dipped to 451. Relatively weak sectors lately include unloose energy shares (XLE) together with healthcare (XLV). Today's trading volition live dominated past times the afternoon's Fed announcement.

* We proceed quite stretched on my intermediate clit measure, which looks at the number of SPX shares making fresh 5, 20, together with 100-day highs versus lows. (Data from Index Indicators). If the Fed-related merchandise can't interruption us from the breadth deterioration, I await an intermediate-term correction. That would non necessarily live an terminate to the bull displace from February's lows, but could advise a new, topping stage to the electrical current marketplace cycle. During a topping stage nosotros tin run across higher overall prices for the index, but amongst deterioration inwards some sectors contributing to lagging breadth.

* Here is a unique intraday indicator that looks at buying clit per unit of measurement area amid all U.S. listed shares. It tracks upticks amid all shares (data from e-Signal) together with expresses the final result inwards measure difference units. This shows us when important buying is coming into the market. It likewise shows us when at that topographic point is a meaningful absence of buying. (A corresponding stair out tracks important selling together with absence of selling pressure). It helps longer-term positions when those are going amongst the flows. The nautical chart below shows yesterday's market.

Tuesday, March 15th

* I'll live making an improver to these marketplace notes together with including each 24-hour interval links to readings that I discovery specially informative together with useful. To boot this off, banking concern check out the Paststat blog for daily trading ideas based upon historical patterns, including this 1 based upon seasonality. From my perspective, such patterns are the starting signal for analysis, non an terminate point. Once nosotros run across a pattern, the difficult piece of occupation remains of deciding: 1) is the electrical current marketplace authorities typical of the menstruum covered past times the historical test; 2) is at that topographic point a audio argue for the beingness of the pattern, or mightiness the designing live a random occurrence; together with 3) what is the variability or together with thus the designing (could yous endure the exceptional instances)? Factoring marketplace history into trading decisions is no guarantee of success--it's slow to aspect inwards together with thus many places that some "significant" designing appears--but ignorance of marketplace history is non just a promising alternative.

* The relative absence of selling clit per unit of measurement area inwards Monday's session was noteworthy together with helped atomic number 82 to higher prices for much of the session earlier a belatedly selling burst. Selling has continued overnight amongst no novel shot inwards the arm from the Bank of Japan. Trading was unusually wearisome on Mon together with nosotros could larn to a greater extent than of the same ahead of tomorrow's Fed announcement. Note how short-term breadth has been potent for a number of days; the stair out below tracks the percent of SPX stocks closing to a higher house their 3, 5, together with 10-day moving averages. (Data from Index Indicators).

* The marketplace looks tired to me--for the origin fourth dimension since the liftoff from the Feb lows. Specifically, we're getting fewer shares registering novel highs during marketplace rallies. Much of that relative weakness is coming from small-scale cap shares. Yesterday nosotros saw 921 stocks across all exchanges brand fresh monthly highs against over 2000 in conclusion week. (Data from the Barchart site). No private sector inside the SPX looks distinctively weak together with I'm non at all convinced that we're going into deport mode. Rather, I await a normal correction inside a bull move. With the absence of selling having problem bringing us higher, I'm leaning toward selling bounces that cannot maintain us to a higher house the overnight highs. Of course, the upcoming Fed annunciation volition supply a major catalyst for stocks tomorrow.

Monday, March 14th

* Those who know me good know that I create non subscribe to the thought that successful trading is by together with large a operate of psychology. Without an objective trading edge, one's frame of bespeak heed volition but dictate the charge per unit of measurement at which nosotros portion amongst our capital. Still, psychology is necessary, if non sufficient, for success together with yesterday's post service was mayhap my clearest explanation why.

* We shut close the highs on Friday, continuing the upswing next the post-ECB selloff. The ascent left us quite stretched short-term, amongst over 90% of SPX stocks trading to a higher house their 3, 5, 10, together with 20-day moving averages. This inwards itself is non a mutual occurrence. Going dorsum to 2006, I could exclusively discovery 12 instances of this happening when VIX has been below 20. Interestingly, three were up, ix downward the side past times side 24-hour interval for a internet loss, but 10 were up, 2 downward after three days. We're trading a fighting lower premarket equally I write; the depth of a side past times side pullback volition state us a lot nearly possible upside momentum over the side past times side few days.

* One line of piece of occupation concern starting to travel inwards my caput is that Friday's highs were the origin inwards which nosotros saw sizable breadth divergences. If nosotros aspect at all stocks across all exchanges, nosotros tin run across that 1087 made fresh monthly highs on Fri against 2082 the prior Friday. Much of this is a operate of relative weakness amid small-scale caps. We exclusively had 92 novel monthly lows on Friday, together with thus naught is standing out equally weak together with I'm non expecting whatsoever grand reversal. I am concerned, however, that nosotros could run across a decent pullback from these levels equally portion of the start of a topping process. Bottom line is that I was happy to receive got profits belatedly Fri together with I'm happy to remain on the sidelines together with run across what the bears tin bring. Ideally, I'd similar to live a buyer of weakness early on inwards the calendar week for at to the lowest degree a retest of highs thereafter. But I'm non seeing favorably skewed risk/reward right here, right now.