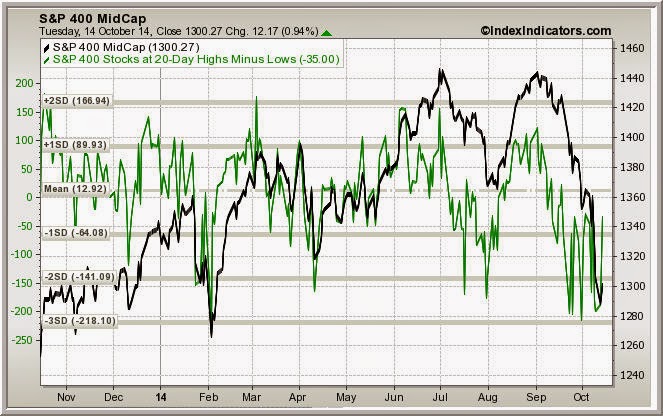

A spell back, I noted that the bull marketplace was over for the bulk of stocks, observing the relative weakness of small-scale cap too midcap shares. After quite a bout of weakness, I'm straight off seeing the emergence of the contrary situation: the give away of small-scale cap too midcap shares making fresh 20-day lows has non been expanding, fifty-fifty though we've seen recent toll weakness too a novel depression for the large cap Dow average. (Credit to Index Indicators for the charts).

Meanwhile, the equity put-call ratio over the by twenty days has exceeded 1.0, levels seen during the May-June, 2010 correction; the August-September, 2011 break; too the reject of May-June, 2012. All were skillful intermediate times to last buying stocks; all were besides choppy, stairstep declines alongside extended periods of basing that included abrupt rallies equally good equally toll erosion. While my Selling Pressure mensurate has been seeing novel lows lately, that pressure level is non translating into to a greater extent than stocks trading below their 20-day moving averages, either amidst large caps, small-scale caps, or midcaps. That is real much on my radar virtually term.

.

No comments:

Post a Comment