The previous 2 posts convey looked at variables that I convey flora useful inwards tracking short-term displace inwards the stock market: buying/selling pressure too volatility. H5N1 tertiary variable I convey flora useful is the breadth of displace amidst stocks.

There are many ways of tracking breadth. Of all of these, I convey flora advance-decline lines to endure amidst the to the lowest degree useful inwards predicting frontwards cost movement. This reflects my to a greater extent than full general sense that the near unremarkably tracked marketplace measures are amidst the to the lowest degree useful, perchance exactly because they are too hence widely tracked.

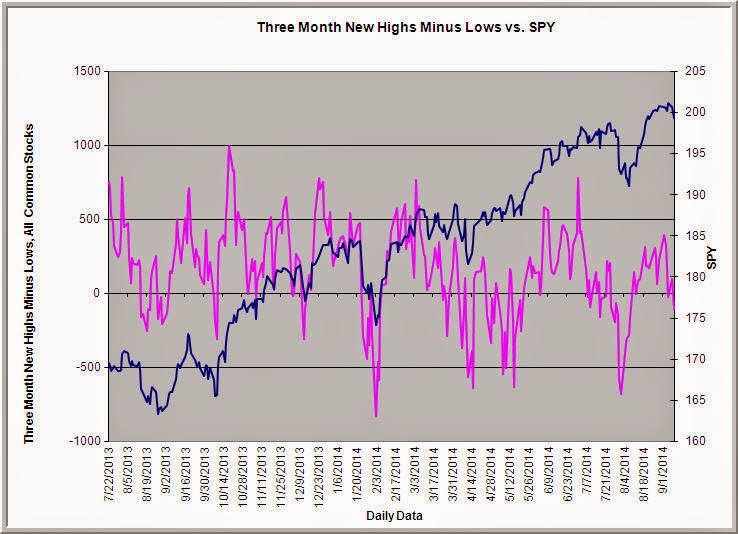

Above are 3 breadth measures that I convey flora to endure useful. The kickoff (top chart) is the publish of mutual stocks across all changes that are making fresh 3 calendar month highs minus those making novel 3 calendar month lows. (Data available from the Barchart site). You tin terminate run into that breadth has deteriorated inwards recent days, leading to the near recent marketplace weakness. You tin terminate also run into that breadth has deteriorated since the early on August decline, every bit the marketplace rally grows increasingly selective.

The 2d mensurate (middle chart) covers all stocks listed on the NYSE too tracks the daily publish that or too hence a higher house their upper Bollinger ring minus those closing below their lower Bollinger band. (Data available from the Stock Charts site). This, too, shows a recent designing of deterioration, fifty-fifty every bit stocks moved to novel highs.

The tertiary breadth mensurate (bottom chart) is specific to the universe of S&P 500 stocks. It is a composite mensurate of the percentages of SPX stocks trading to a higher house their 3, 5, 10, too twenty solar daytime averages. (Data available from the Index Indicators site). What nosotros run into 1 time to a greater extent than is a vogue for this mensurate to peak ahead of price, every bit has happened near recently.

In general, I honor that rigid breadth leads to short-term upside momentum, followed yesteryear reversal. Weak breadth leads to short-term downside momentum at of import marketplace bottoms (i.e., bottoms of longer-term marketplace cycles) too short-term reversal at marketplace corrections. In a qualitative sense, these measures reach me a moving painting on whether markets are getting stronger or weaker solar daytime over day--very useful data for gauging where nosotros mightiness endure at inwards a marketplace cycle.

Further Reading: Useful Trading Tools: Breadth

.