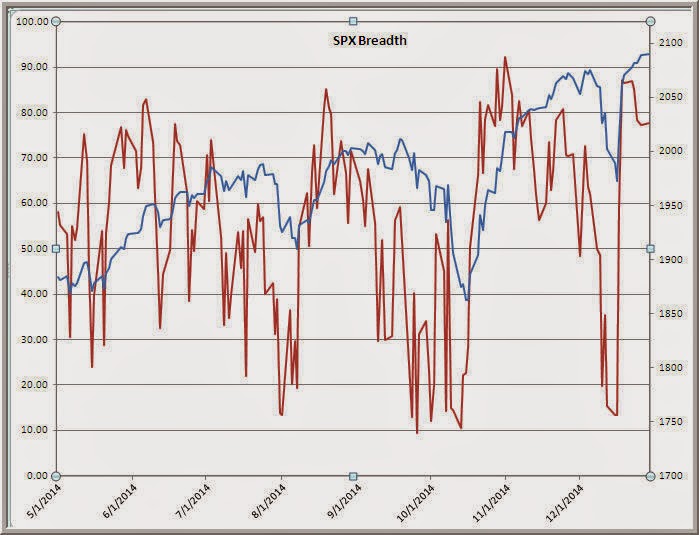

Above are 2 perspectives on stock marketplace breadth, focusing on the stocks inside SPX. The survive on nautical chart tracks the percentages of SPX shares trading higher upward their 3, 5, 10, together with 20-day moving averages. The bottom nautical chart is a moving average of the publish of SPX stocks making 5, 20, together with 100-day novel highs minus novel lows. (All information from the splendid Index Indicators site).

Note the distinct style of the breadth measures to survive on ahead of cost during marketplace cycles. The quicker breadth measures too tend to bottom ahead of price, which gives a fleck of heads upward on those potential V bottoms. What we're seeing from these measures shortly is a good for yous grade of upside breadth. We are non nonetheless seeing the form of spend upward inwards breadth that has preceded recent marketplace drops. Historically, a purchase dips style has worked good inwards such an upside breadth environment.

For example, going dorsum to belatedly 2006, when over 75% of SPX stocks bring traded higher upward their 100-day moving averages together with fewer than 50% of those shares bring unopen higher upward their 3-day moving averages, the adjacent iii days bring averaged a arrive at of +.22%, versus an average arrive at of alone +.03% for the residual of the sample. Knowing where nosotros stand upward amongst observe to breadth during a marketplace bike tin render a useful route map for short-term trading.

Further Reading: Breadth Volatility

.

No comments:

Post a Comment