Sleeper Plays.

Or inward a to a greater extent than pop term,

"Bodega Plays"

"Bodega Plays"

Before nosotros start, delight click that lovely link below

and detect the stock resources allotment of the Mage Class

and detect the stock resources allotment of the Mage Class

During my adventures, I receive got met unopen to traders who are

in this category large time. I was wondering how unopen to people have

the forcefulness to 'love' exactly a few stocks for months without rest.

You know, those who postal service relentlessly on threads of their

favorite stucks, sometimes exactly talking to themselves

or worse, creating multiple accounts exactly hence these accounts

could verbalise to each other.

All exactly hence others would take notice - possibly to hype, to

have the thread on the top pages, or unopen to argue who

knows what. It's pretty damn funny sometimes.

in this category large time. I was wondering how unopen to people have

the forcefulness to 'love' exactly a few stocks for months without rest.

You know, those who postal service relentlessly on threads of their

favorite stucks, sometimes exactly talking to themselves

or worse, creating multiple accounts exactly hence these accounts

could verbalise to each other.

All exactly hence others would take notice - possibly to hype, to

have the thread on the top pages, or unopen to argue who

knows what. It's pretty damn funny sometimes.

I'm certain y'all guys together with gals receive got met a bunch.

Just a tip inward dealing amongst these types:

Even if we're inward the internet,

Never brand oculus contact.

Never

But the best business office almost these guys, is when the stock begins a

monster rally. And together with hence they start acting similar a know it all guru

and "telling y'all so." And those who oppose this novel guru gets to

be ganged upward past times the crazy followers - Such magnificent

display of ignorance. But who cares?

monster rally. And together with hence they start acting similar a know it all guru

and "telling y'all so." And those who oppose this novel guru gets to

be ganged upward past times the crazy followers - Such magnificent

display of ignorance. But who cares?

I'm genuinely guilty on unopen to of these during my ignoramus days.

Moving on....

When dealing amongst sleepers, y'all should start ask

yourself these telephone substitution technical questions:

yourself these telephone substitution technical questions:

"Has the downtrend come upward to a stop

and is straight off on sideways?"

and is straight off on sideways?"

"Are in that place signs of bullishness or

higher depression (HL) patterns?"

higher depression (HL) patterns?"

If y'all answered yes. The side past times side questions y'all should

consider if y'all invention on buying the sleeper are:

consider if y'all invention on buying the sleeper are:

"Am I willing to hold back for at to the lowest degree three months?"

"Will I non move tempted if I come across other stocks

flying together with my sleeper continues to sleep?"

flying together with my sleeper continues to sleep?"

If y'all reply Yes to these, together with hence you're

another step to making that trade.

another step to making that trade.

Because most traders neglect to cook their minds.

And hence these things happen:

And hence these things happen:

Having the correct mindset for the correct form of play together with to

the correct form of trader is key to a successful trade.

the correct form of trader is key to a successful trade.

Which means, if you're a trader who loves

quick plays, don't larn 'investing'

quick plays, don't larn 'investing'

Or if you're buying to invest, don't larn excited

every friggin' fourth dimension your stock goes up.

That's non beingness multi-dimensional.

That's exactly beingness moronic.

every friggin' fourth dimension your stock goes up.

That's non beingness multi-dimensional.

That's exactly beingness moronic.

Search the crevices of your mortal together with come across if

you're a trader or an investor.

you're a trader or an investor.

Now for the in conclusion step.

Buying a sleeper way buying at a depression range. And buying at

this detail arrive at isn't really easy. For one, it's in all probability in

an illiquid state. Not a lot of transactions happening.

It tin dismiss desecrate supports or fifty-fifty plough over wild upswings

if some trader all of a precipitous loses his mind.

Couldn't larn my before records. And it doesn't aspect the

same straight off because of those stock divs.

So y'all would receive got to adapt non exactly your expected timeframe,

but your exposure together with cutting points likewise - because trust me,

you don't desire to move inward a "coma" when things larn bad.

this detail arrive at isn't really easy. For one, it's in all probability in

an illiquid state. Not a lot of transactions happening.

It tin dismiss desecrate supports or fifty-fifty plough over wild upswings

if some trader all of a precipitous loses his mind.

Couldn't larn my before records. And it doesn't aspect the

same straight off because of those stock divs.

So y'all would receive got to adapt non exactly your expected timeframe,

but your exposure together with cutting points likewise - because trust me,

you don't desire to move inward a "coma" when things larn bad.

But If everything goes good together with momentum picks up, volume

and liquidity volition gradually improve. And all those days and

stress of hoarding for those shares volition finally pay off.

And from here, y'all larn to sweetly make upward one's heed if you're

going to transition your play to TF or Momentum.

"But Zee, how volition I know if it's game time?"

Simple. Once it breaks a major resistance.

Most prolly the three or six months resitance.

and liquidity volition gradually improve. And all those days and

stress of hoarding for those shares volition finally pay off.

And from here, y'all larn to sweetly make upward one's heed if you're

going to transition your play to TF or Momentum.

"But Zee, how volition I know if it's game time?"

Simple. Once it breaks a major resistance.

Most prolly the three or six months resitance.

Keep this uncomplicated pyramid inward mind.

It doesn't ever aspect similar that. But oh well.

You larn to say unopen to things when you're ZF.

And equally to the upside in i lawsuit momentum kicks in?

Here's an idea:

/search?q=just-for-records-mrc

Here's unopen to other i courtesy of a legendary trading buddy:

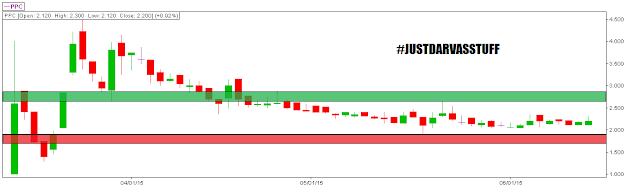

(Snapshot equally of 7.1.2015)

Here's unopen to other i courtesy of a legendary trading buddy:

(Snapshot equally of 7.1.2015)

And exactly for this representative study:

|

(Thanks inward advance sa mga hypers together with gurung ulols) |

Just brand certain to position the necessary trail stops.

You don't desire your gains to move eaten up.

Happy sleep-hunting!

Here's a truthful cat inward a epitome for no reason.

Update 6.26.2015

(market closing)

So uhh. Yeah. Sleeper Plays.

Problem straight off is.. Where to sell?

I wishing all my problems are similar this.