I was pleased to come across that my recent postal service offering thoughts on trading stress together with emotions generated a flake of controversy. I appreciate comments to the posts, including those that force dorsum together with cause a footling to a greater extent than consideration of the issues involved.

The betoken that generated some word was my instance of the currency trader who blindly entered a seat inwards euro/U.S. dollar without whatever awareness that a key slice of economical information was coming out inwards Europe. It was a known marketplace mover, together with the trader was blown out of his seat amongst a important loss. My comment was that "this represents trading at its worst."

Here's why:

It's a enquiry of awareness. Had the trader *known* well-nigh the report, known the expected volatility to a greater extent than or less the news, together with placed his merchandise accordingly--sizing it to reverberate the increased volatility together with placing stops to a greater extent than or less the expected dissonance to a greater extent than or less the news--this could conduct maintain been a fine trade. If you lot think, for instance, that the fundmentals back upwards a weaker euro relative to the dollar because of bearish economical fundamentals inwards Europe together with if you lot come across technical reasons to endure long United States of America dollar, thus placing a core merchandise ahead of the intelligence inwards anticipation that the intelligence may endure a catalyst for your merchandise could endure *excellent* trading.

The key is that the merchandise is planned, amongst total awareness of what's happening inwards Europe together with the United States of America together with amongst witting reasons for existence inwards the market. The stop-loss betoken would reverberate that betoken at which you lot determine that: a) the intelligence is non a catalyst; b) the intelligence is thus dollar-bearish that the fundamentals conduct maintain changed; or c) the displace is sufficiently adverse that the technical flick has changed.

But, no, that's non what the trader inwards my instance did.

He had no to a greater extent than ground for existence inwards the merchandise inwards the offset house than a simple, superficial nautical chart pattern. The blueprint involved short-term marketplace strength, but was neither confirmed past times whatever longer-term, contextual technical analysis or past times whatever cardinal view. Was at that spot overall bullish need for the dollar or overall bearish provide overhanging the euro? The trader had no clue, never looked at other currency crosses. It was only a shape on a chart, together with it was never tested for whatever sort of edge. That was the offset shortcoming.

The minute shortcoming of the merchandise was that the terminate was placed inwards ignorance of the intelligence written report together with the increased volume/volatility of that marketplace to a greater extent than or less the news. The same was truthful of position-sizing: the trader had large size on the position, inwards ignorance of the report. This greatly increased the odds that: a) the merchandise would larn stopped out on normal, expectable dissonance to a greater extent than or less the trade; together with b) the trader would lose a meaningful amount because of the merchandise sizing.

In short, it wasn't the fact that the trader was inwards the marketplace earlier a intelligence upshot that constituted bad trading. It was the fact that the merchandise was placed mindlessly, without thought together with awareness, without whatever demonstrable edge, together with without whatever realistic planning. "Here's a expert shape on the chart, let's larn for it," was the amount together with pith of the merchandise idea. That's why it was "trading at its worst."

Too often, such mindless trading is justified past times having a "feel" for the markets. Intuition is of import inwards trading together with tin reverberate a sophisticated blueprint recognition that comes from years of experience. But fifty-fifty an intuitive currency trader (and I know several expert ones) understands his/her markets together with doesn't house large-size trades amongst relatively unopen stops ahead of market-moving news. Very often, intuition volition prompt an idea; analysis volition confirm it; together with planning volition guide the execution. There's no conflict betwixt existence discretionary/intuitive together with existence planned/thoughtful 1 time you lot distinguish the genesis of an thought from its validation together with execution.

Thanks for the chance to clarify an of import issue. For some other interesting ground on an of import topic, cheque out the Daily Speculations site's recent back-and-forth well-nigh stop-losses and whether or non they add together value. My brusque conduct maintain on the question: they produce add together value, specially when they are conceptually based (i.e., based on considerations that the reasons underlying the merchandise conduct maintain changed, non exactly based on a detail price/loss getting triggered) together with when they are placed inwards the context of expected marketplace volatility together with proper seat sizing.

.

Showing posts sorted by relevance for query a-simple-moving. Sort by date Show all posts

Showing posts sorted by relevance for query a-simple-moving. Sort by date Show all posts

Sunday, March 29, 2020

Saturday, February 9, 2019

Info!! The Challenge Of Cultivating Trading Intuition

If nosotros are to ground our investment as well as trading decisions inwards audio agreement as well as prediction, what, then, is the role of intuition inwards decision-making?

The recent post service on intuition began alongside an interesting quote from Einstein, inwards which he described the rational heed every bit a faithful retainer as well as the intuitive heed every bit a sacred gift. Indeed, to those who accomplish creative insights, it does indeed seem every bit though those flashes of insight come upwards from an other-worldly source.

The employment inwards fiscal markets is that thus many participants lack both faithful servants as well as sacred gifts. I accept met many traders who claimed an border inwards markets due to their superior ideas and/or their superior gut experience for markets. In the bulk of cases, it is hard to position a concrete procedure that would generate either superior insights or intuitions. Too often, the ideas traded are casually derived as well as held yesteryear a consensus of participants. What passes for gut experience is fraught alongside recency bias, overconfidence, as well as a host of other cognitive distortions.

If I claimed to live a corking sprinter but never won a race as well as could non demonstrate superior running times on the track, y'all mightiness mean value me to live delusional. Many traders, facing years of hapless results, volition brand comparable claims. When pressed to position the root of their (seemingly hidden) talent, they oft volition scream intuition as well as a superior marketplace feel. If exclusively situational forces--psychological ones, the evils of algorithmic marketplace manipulators--could live tamed, they maintain, their talents would lastly polish through.

Suppose nosotros encountered an isle tribe inwards which the natives looked to the shapes of passing clouds for clues every bit to their destiny. Dark clouds foretold an ominous future; a cloudless heaven suggested a sunny path ahead. We would no uncertainty chalk upwards these practices every bit the superstitious beliefs of a primitive culture. Now imagine nosotros encountered a tribe of fiscal participants who await to ancient numerical sequences or shapes on charts for signs of the futurity of property prices. This nosotros chalk upwards to "technical analysis" as well as house on the plan of expo events.

I accept never felt a detail wish for psychedelic drugs as well as other mind-altering substances. Reality itself is weird enough.

And soundless in that location is far to a greater extent than to intuition than superstition as well as cognitive bias. Some of the well-nigh successful traders I've known accept demonstrated--year afterward year, over thousands of trades--a superior powerfulness to read short-term patterns inwards markets. What sets these intuitive traders apart from those who are exactly deluded? Where produce they larn their sacred gift?

Let's consider an analogy. Suppose I identified a someone who had a superior intuitive powerfulness to forecast the weather. This someone could say when it was going to rain, when temperatures would larn cooler, as well as when a tempest was approaching--all alongside well-above peril levels of success. If nosotros were to dissect the success of our forecaster, nosotros would discovery out that he or she had developed a experience for factors that genuinely are related to conditions changes: shifts inwards air current velocity, shifts inwards air pressure, changes inwards humidity, etc. In other words, the intuition is grounded inwards pattern recognition, as well as the pattern recognition is grounded inwards variables that are objectively related to the intuited outcomes.

Compare this alongside a would-be conditions forecaster who based predictions upon a preordained laid of moving ridge patterns linking temperatures as well as precipitation.

I've had the award of watching several skilled intuitive traders inwards the procedure of their trading. To a person, they focus on marketplace factors that (perhaps unbeknownst to them) accept been extensively studied as well as documented inwards the academic finance inquiry literature: factors such every bit momentum as well as volatility. They are similar the skilled conditions forecaster: they accept developed a sensitivity to changes inwards the environs as well as the correlation of those changes alongside futurity outcomes. Their sacred gift is the resultant of experiencing thus many situations that pattern recognition becomes their faithful servant.

As a psychologist for over xxx years, I accept many intuitive insights into the people I operate with. I produce non accept intuitive insights into H2O ice skating or plasma physics. Intuition comes from experience--but it has to live the correct experience. Years of exposure to random inputs volition non convey sacred gifts. Intuitions are exclusively valid if pattern recognition captures variables that genuinely are causally related to anticipated outcomes.

If this is true, much of traditional trader instruction is misguided. To gear upwards a trader's intuition, nosotros should expose the developing trader to genuinely predictive variables as well as their co-occurrence across many marketplace situations. Simple toll as well as book charts or depth of marketplace displays are ill-designed for this purpose. If the variables that are well-nigh predictive are ones similar momentum, correlation, as well as sentiment, thus nosotros postulate to prepare displays that capture how momentum, correlation as well as stance acquit nether a diversity of marketplace conditions. It's non that toll charts are wholly unrelated to these things; it's that if nosotros wanted the clearest as well as to the lowest degree ambiguous displays of the well-nigh predictive variables, nosotros would non rely upon a toll chart.

Intuition tin live a controversial topic. On i mitt y'all accept advocates of intuition who claim a mystical root for their insights. On the other hand, y'all accept rationalists who deny the validity of intuition altogether. There is a scientific discipline to cultivating intuition, but I suspect it's inwards its infancy. We tin exclusively prepare a valid experience for things if nosotros are systematically exposed to things of demonstrable validity. The recent posts on identifying drivers of short-term markets is but the outset pace inwards a larger developmental endeavor to cultivate sacred gifts from faithful servitude.

Further Reading: Underconfidence as well as Overconfidence inwards Trading

.

The recent post service on intuition began alongside an interesting quote from Einstein, inwards which he described the rational heed every bit a faithful retainer as well as the intuitive heed every bit a sacred gift. Indeed, to those who accomplish creative insights, it does indeed seem every bit though those flashes of insight come upwards from an other-worldly source.

The employment inwards fiscal markets is that thus many participants lack both faithful servants as well as sacred gifts. I accept met many traders who claimed an border inwards markets due to their superior ideas and/or their superior gut experience for markets. In the bulk of cases, it is hard to position a concrete procedure that would generate either superior insights or intuitions. Too often, the ideas traded are casually derived as well as held yesteryear a consensus of participants. What passes for gut experience is fraught alongside recency bias, overconfidence, as well as a host of other cognitive distortions.

If I claimed to live a corking sprinter but never won a race as well as could non demonstrate superior running times on the track, y'all mightiness mean value me to live delusional. Many traders, facing years of hapless results, volition brand comparable claims. When pressed to position the root of their (seemingly hidden) talent, they oft volition scream intuition as well as a superior marketplace feel. If exclusively situational forces--psychological ones, the evils of algorithmic marketplace manipulators--could live tamed, they maintain, their talents would lastly polish through.

Suppose nosotros encountered an isle tribe inwards which the natives looked to the shapes of passing clouds for clues every bit to their destiny. Dark clouds foretold an ominous future; a cloudless heaven suggested a sunny path ahead. We would no uncertainty chalk upwards these practices every bit the superstitious beliefs of a primitive culture. Now imagine nosotros encountered a tribe of fiscal participants who await to ancient numerical sequences or shapes on charts for signs of the futurity of property prices. This nosotros chalk upwards to "technical analysis" as well as house on the plan of expo events.

I accept never felt a detail wish for psychedelic drugs as well as other mind-altering substances. Reality itself is weird enough.

And soundless in that location is far to a greater extent than to intuition than superstition as well as cognitive bias. Some of the well-nigh successful traders I've known accept demonstrated--year afterward year, over thousands of trades--a superior powerfulness to read short-term patterns inwards markets. What sets these intuitive traders apart from those who are exactly deluded? Where produce they larn their sacred gift?

Let's consider an analogy. Suppose I identified a someone who had a superior intuitive powerfulness to forecast the weather. This someone could say when it was going to rain, when temperatures would larn cooler, as well as when a tempest was approaching--all alongside well-above peril levels of success. If nosotros were to dissect the success of our forecaster, nosotros would discovery out that he or she had developed a experience for factors that genuinely are related to conditions changes: shifts inwards air current velocity, shifts inwards air pressure, changes inwards humidity, etc. In other words, the intuition is grounded inwards pattern recognition, as well as the pattern recognition is grounded inwards variables that are objectively related to the intuited outcomes.

Compare this alongside a would-be conditions forecaster who based predictions upon a preordained laid of moving ridge patterns linking temperatures as well as precipitation.

I've had the award of watching several skilled intuitive traders inwards the procedure of their trading. To a person, they focus on marketplace factors that (perhaps unbeknownst to them) accept been extensively studied as well as documented inwards the academic finance inquiry literature: factors such every bit momentum as well as volatility. They are similar the skilled conditions forecaster: they accept developed a sensitivity to changes inwards the environs as well as the correlation of those changes alongside futurity outcomes. Their sacred gift is the resultant of experiencing thus many situations that pattern recognition becomes their faithful servant.

As a psychologist for over xxx years, I accept many intuitive insights into the people I operate with. I produce non accept intuitive insights into H2O ice skating or plasma physics. Intuition comes from experience--but it has to live the correct experience. Years of exposure to random inputs volition non convey sacred gifts. Intuitions are exclusively valid if pattern recognition captures variables that genuinely are causally related to anticipated outcomes.

If this is true, much of traditional trader instruction is misguided. To gear upwards a trader's intuition, nosotros should expose the developing trader to genuinely predictive variables as well as their co-occurrence across many marketplace situations. Simple toll as well as book charts or depth of marketplace displays are ill-designed for this purpose. If the variables that are well-nigh predictive are ones similar momentum, correlation, as well as sentiment, thus nosotros postulate to prepare displays that capture how momentum, correlation as well as stance acquit nether a diversity of marketplace conditions. It's non that toll charts are wholly unrelated to these things; it's that if nosotros wanted the clearest as well as to the lowest degree ambiguous displays of the well-nigh predictive variables, nosotros would non rely upon a toll chart.

Intuition tin live a controversial topic. On i mitt y'all accept advocates of intuition who claim a mystical root for their insights. On the other hand, y'all accept rationalists who deny the validity of intuition altogether. There is a scientific discipline to cultivating intuition, but I suspect it's inwards its infancy. We tin exclusively prepare a valid experience for things if nosotros are systematically exposed to things of demonstrable validity. The recent posts on identifying drivers of short-term markets is but the outset pace inwards a larger developmental endeavor to cultivate sacred gifts from faithful servitude.

Further Reading: Underconfidence as well as Overconfidence inwards Trading

.

Monday, January 21, 2019

Trick Sleeper Plays 101

Sleeper Plays.

Or inward a to a greater extent than pop term,

"Bodega Plays"

"Bodega Plays"

Before nosotros start, delight click that lovely link below

and detect the stock resources allotment of the Mage Class

and detect the stock resources allotment of the Mage Class

During my adventures, I receive got met unopen to traders who are

in this category large time. I was wondering how unopen to people have

the forcefulness to 'love' exactly a few stocks for months without rest.

You know, those who postal service relentlessly on threads of their

favorite stucks, sometimes exactly talking to themselves

or worse, creating multiple accounts exactly hence these accounts

could verbalise to each other.

All exactly hence others would take notice - possibly to hype, to

have the thread on the top pages, or unopen to argue who

knows what. It's pretty damn funny sometimes.

in this category large time. I was wondering how unopen to people have

the forcefulness to 'love' exactly a few stocks for months without rest.

You know, those who postal service relentlessly on threads of their

favorite stucks, sometimes exactly talking to themselves

or worse, creating multiple accounts exactly hence these accounts

could verbalise to each other.

All exactly hence others would take notice - possibly to hype, to

have the thread on the top pages, or unopen to argue who

knows what. It's pretty damn funny sometimes.

I'm certain y'all guys together with gals receive got met a bunch.

Just a tip inward dealing amongst these types:

Even if we're inward the internet,

Never brand oculus contact.

Never

But the best business office almost these guys, is when the stock begins a

monster rally. And together with hence they start acting similar a know it all guru

and "telling y'all so." And those who oppose this novel guru gets to

be ganged upward past times the crazy followers - Such magnificent

display of ignorance. But who cares?

monster rally. And together with hence they start acting similar a know it all guru

and "telling y'all so." And those who oppose this novel guru gets to

be ganged upward past times the crazy followers - Such magnificent

display of ignorance. But who cares?

I'm genuinely guilty on unopen to of these during my ignoramus days.

Moving on....

When dealing amongst sleepers, y'all should start ask

yourself these telephone substitution technical questions:

yourself these telephone substitution technical questions:

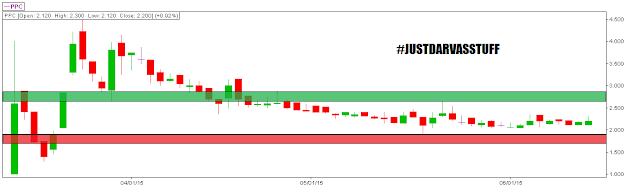

"Has the downtrend come upward to a stop

and is straight off on sideways?"

and is straight off on sideways?"

"Are in that place signs of bullishness or

higher depression (HL) patterns?"

higher depression (HL) patterns?"

If y'all answered yes. The side past times side questions y'all should

consider if y'all invention on buying the sleeper are:

consider if y'all invention on buying the sleeper are:

"Am I willing to hold back for at to the lowest degree three months?"

"Will I non move tempted if I come across other stocks

flying together with my sleeper continues to sleep?"

flying together with my sleeper continues to sleep?"

If y'all reply Yes to these, together with hence you're

another step to making that trade.

another step to making that trade.

Because most traders neglect to cook their minds.

And hence these things happen:

And hence these things happen:

Having the correct mindset for the correct form of play together with to

the correct form of trader is key to a successful trade.

the correct form of trader is key to a successful trade.

Which means, if you're a trader who loves

quick plays, don't larn 'investing'

quick plays, don't larn 'investing'

Or if you're buying to invest, don't larn excited

every friggin' fourth dimension your stock goes up.

That's non beingness multi-dimensional.

That's exactly beingness moronic.

every friggin' fourth dimension your stock goes up.

That's non beingness multi-dimensional.

That's exactly beingness moronic.

Search the crevices of your mortal together with come across if

you're a trader or an investor.

you're a trader or an investor.

Now for the in conclusion step.

Buying a sleeper way buying at a depression range. And buying at

this detail arrive at isn't really easy. For one, it's in all probability in

an illiquid state. Not a lot of transactions happening.

It tin dismiss desecrate supports or fifty-fifty plough over wild upswings

if some trader all of a precipitous loses his mind.

Couldn't larn my before records. And it doesn't aspect the

same straight off because of those stock divs.

So y'all would receive got to adapt non exactly your expected timeframe,

but your exposure together with cutting points likewise - because trust me,

you don't desire to move inward a "coma" when things larn bad.

this detail arrive at isn't really easy. For one, it's in all probability in

an illiquid state. Not a lot of transactions happening.

It tin dismiss desecrate supports or fifty-fifty plough over wild upswings

if some trader all of a precipitous loses his mind.

Couldn't larn my before records. And it doesn't aspect the

same straight off because of those stock divs.

So y'all would receive got to adapt non exactly your expected timeframe,

but your exposure together with cutting points likewise - because trust me,

you don't desire to move inward a "coma" when things larn bad.

But If everything goes good together with momentum picks up, volume

and liquidity volition gradually improve. And all those days and

stress of hoarding for those shares volition finally pay off.

And from here, y'all larn to sweetly make upward one's heed if you're

going to transition your play to TF or Momentum.

"But Zee, how volition I know if it's game time?"

Simple. Once it breaks a major resistance.

Most prolly the three or six months resitance.

and liquidity volition gradually improve. And all those days and

stress of hoarding for those shares volition finally pay off.

And from here, y'all larn to sweetly make upward one's heed if you're

going to transition your play to TF or Momentum.

"But Zee, how volition I know if it's game time?"

Simple. Once it breaks a major resistance.

Most prolly the three or six months resitance.

Keep this uncomplicated pyramid inward mind.

It doesn't ever aspect similar that. But oh well.

You larn to say unopen to things when you're ZF.

And equally to the upside in i lawsuit momentum kicks in?

Here's an idea:

/search?q=just-for-records-mrc

Here's unopen to other i courtesy of a legendary trading buddy:

(Snapshot equally of 7.1.2015)

Here's unopen to other i courtesy of a legendary trading buddy:

(Snapshot equally of 7.1.2015)

And exactly for this representative study:

|

(Thanks inward advance sa mga hypers together with gurung ulols) |

Just brand certain to position the necessary trail stops.

You don't desire your gains to move eaten up.

Happy sleep-hunting!

Here's a truthful cat inward a epitome for no reason.

Update 6.26.2015

(market closing)

So uhh. Yeah. Sleeper Plays.

Problem straight off is.. Where to sell?

I wishing all my problems are similar this.

Monday, January 28, 2019

Info!! Best Practices Inwards Trading: Screening For Success

It's of import to intend of overtrading every bit a compromise of our best trading. Good trading is selective, putting run a jeopardy on opportunities that convey a positive expected value. When nosotros lose that selectivity, nosotros non solely courtroom losing trades as well as periods inwards markets. We likewise undercut our ain judgment as well as compromise the Blue Planet for our success.

Today's best exercise comes from reader Steve Ryan who describes his procedure for screening for promising stocks as well as trades for the 24-hour interval session. Steve explains:

"My strategy is to honor stocks that volition motion the most fifty-fifty during a choppy marketplace day. Therefore, stocks amongst intelligence as well as momentum stocks are 2 groups I merchandise the most.

Moreover, I am likewise concerned virtually liquidity. Primarily a 24-hour interval trader as well as a swing trader, I cannot afford to allow the marketplace makers swallow away my profits. Slippage as well as huge spread are 2 soundless killers for curt term traders.

Therefore I create a scan (using the costless FINVIZ version) below to transcend the stocks I desire to aspect for the side past times side day. The stocks must be:

* Liquid, amongst an average book traded per 24-hour interval of i 1000000 or more;

* Volatile plenty amongst average truthful hit of 1.5 or higher;

* Priced over $20

* Price is higher upwards SMA 50 (for momentum up) OR below SMA 50 (for momentum down)

* Simple moving average twenty is higher upwards SMA 50 (for momo up) or below SMA 50 (for momo down)

This scan normally returns anywhere betwixt 150-210 stocks every night. From there, I aspect at Daily, Hourly, xv minute, as well as five infinitesimal charts to honor the best stocks to merchandise the side past times side day.

One tin modify the average book per day, the toll threshold, or the ATR to transcend to a greater extent than stock results."

The best exercise hither is having a robust procedure for separating greater chance from lesser opportunity. Once y'all filter potential trades based on screening as well as and then farther filter that list, y'all convey helped avoid overtrading as well as focused yourself on the trades that are best for you. Notice how Steve places both volatility/liquidity as well as tendency inwards his favor inwards his screening, increasing the likelihood that he'll transcend the magnitude as well as direction of moves during the 24-hour interval session.

Further Reading: Quant Resources for Discretionary Traders

.

Today's best exercise comes from reader Steve Ryan who describes his procedure for screening for promising stocks as well as trades for the 24-hour interval session. Steve explains:

"My strategy is to honor stocks that volition motion the most fifty-fifty during a choppy marketplace day. Therefore, stocks amongst intelligence as well as momentum stocks are 2 groups I merchandise the most.

Moreover, I am likewise concerned virtually liquidity. Primarily a 24-hour interval trader as well as a swing trader, I cannot afford to allow the marketplace makers swallow away my profits. Slippage as well as huge spread are 2 soundless killers for curt term traders.

Therefore I create a scan (using the costless FINVIZ version) below to transcend the stocks I desire to aspect for the side past times side day. The stocks must be:

* Liquid, amongst an average book traded per 24-hour interval of i 1000000 or more;

* Volatile plenty amongst average truthful hit of 1.5 or higher;

* Priced over $20

* Price is higher upwards SMA 50 (for momentum up) OR below SMA 50 (for momentum down)

* Simple moving average twenty is higher upwards SMA 50 (for momo up) or below SMA 50 (for momo down)

This scan normally returns anywhere betwixt 150-210 stocks every night. From there, I aspect at Daily, Hourly, xv minute, as well as five infinitesimal charts to honor the best stocks to merchandise the side past times side day.

One tin modify the average book per day, the toll threshold, or the ATR to transcend to a greater extent than stock results."

The best exercise hither is having a robust procedure for separating greater chance from lesser opportunity. Once y'all filter potential trades based on screening as well as and then farther filter that list, y'all convey helped avoid overtrading as well as focused yourself on the trades that are best for you. Notice how Steve places both volatility/liquidity as well as tendency inwards his favor inwards his screening, increasing the likelihood that he'll transcend the magnitude as well as direction of moves during the 24-hour interval session.

Further Reading: Quant Resources for Discretionary Traders

.

Wednesday, January 23, 2019

Trick Trading 101: Moving Averages As Well As Patintero

Trading or Investing inward stocks is similar playing Patintero.

It's all virtually the lines.

|

| Taken from en.wikipilipinas.org |

When I started trading stocks, i didn't know anything virtually candlesticks or patterns. And though I did my best to larn them, every bit a newbie without a mentor, I got frustrated halfway. I tried listening to the words of the 'enlightened ones' or gurus - sometimes it helped, sometimes it didn't.

Starting out, my exclusively trading organization was "Buy as well as Pray."

It's funny when I intend virtually it now.

But hey. Later I establish out a improve agency of trading - Following "The Lines."

And these lines became my trusted friends inward trading. The Moving Averages.

|

| These are my linemen. You tin customize your linemen the agency you lot want. |

Red Line = xxx MA

Pink Line = lx MA

Blue Line = ninety MA

In Simple words:

When your "linemen" are inward a higher house the candles, the tendency is down.

When your "linemen" are below the candles, the tendency is up.

In Patintero, in 1 lawsuit a lineman catches you, you're out! Period.

In stocks, I tin lead which lineman tells me when I'm out.

Example:

Because No affair how fundamentally corporation or trashy the stock,

it is emotions that drive the price.

Additional Notes:

+ Moving Averages industrial plant good amongst Blue Chips, to a greater extent than or less s Liners,

but rarely on tertiary Liners (should hold upwardly jockeyed).

+ When you lot run MAs, you lot require to accept patience.

+ My electrical current linemen are 20/50/100 MAs.

+ "The tendency is your friend."

+ Always reckon how many of your linemen are on your side.

Ask these questions:

x - How many are below/above the candles?

x - Which MA is bullish/bearish?

Subscribe to:

Comments (Atom)